Question: Preview File Edit View Go Tools Window Help A 51% % Sun 17 Oct 11:28 AM - MBA forecast.png Q Q Q Search G +

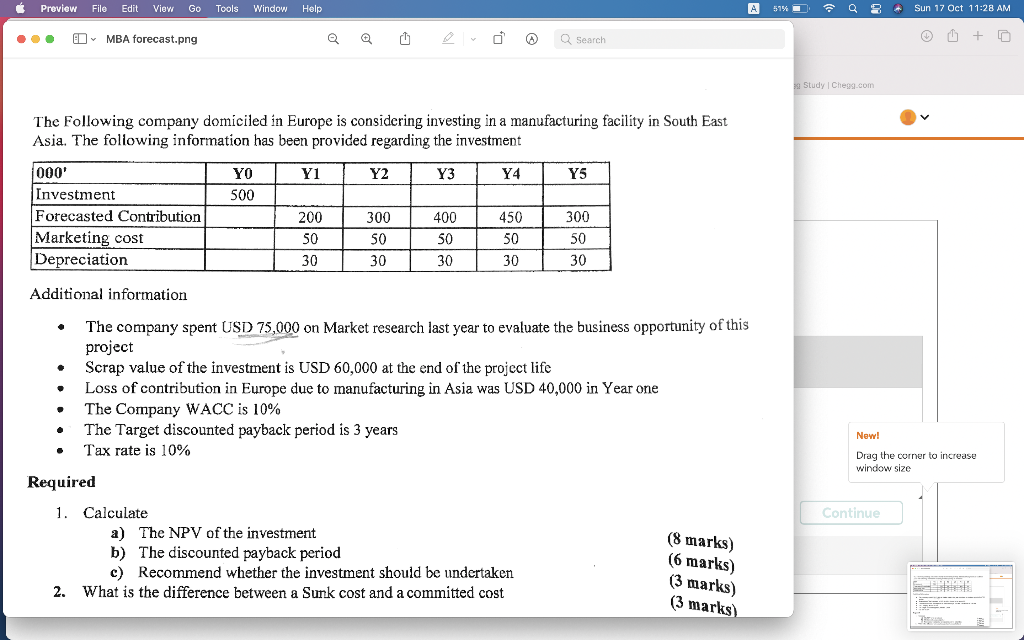

Preview File Edit View Go Tools Window Help A 51% % Sun 17 Oct 11:28 AM - MBA forecast.png Q Q Q Search G + Study | Chegg.com The following company domiciled in Europe is considering investing in a manufacturing facility in South East Asia. The following information has been provided regarding the investment Y1 Y2 Y3 Y4 YS YO 500 1000' Investment Forecasted Contribution Marketing cost Depreciation 200 50 30 300 SO 400 SO 450 50 30 300 50 30 30 30 Additional information . The company spent USD 75,000 on Market research last year to evaluate the business opportunity of this project Scrap value of the investment is USD 60,000 at the end of the project life Loss of contribution in Europe due to manufacturing in Asia was USD 40,000 in Year one The Company WACC is 10% The Target discounted payback period is 3 years Tax rate is 10% New! . Drag the corner to increase window size Continue Required 1. Calculate a) The NPV of the investment b) The discounted payback period c) Recommend whether the investment should be undertaken 2. What is the difference between a Sunk cost and a committed cost (8 marks) (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts