Question: previous chegg answer are wrong so please don't copy paste Suppose that the index model for stocks A and B is estimated from excess returns

previous chegg answer are wrong so please don't copy paste

previous chegg answer are wrong so please don't copy paste

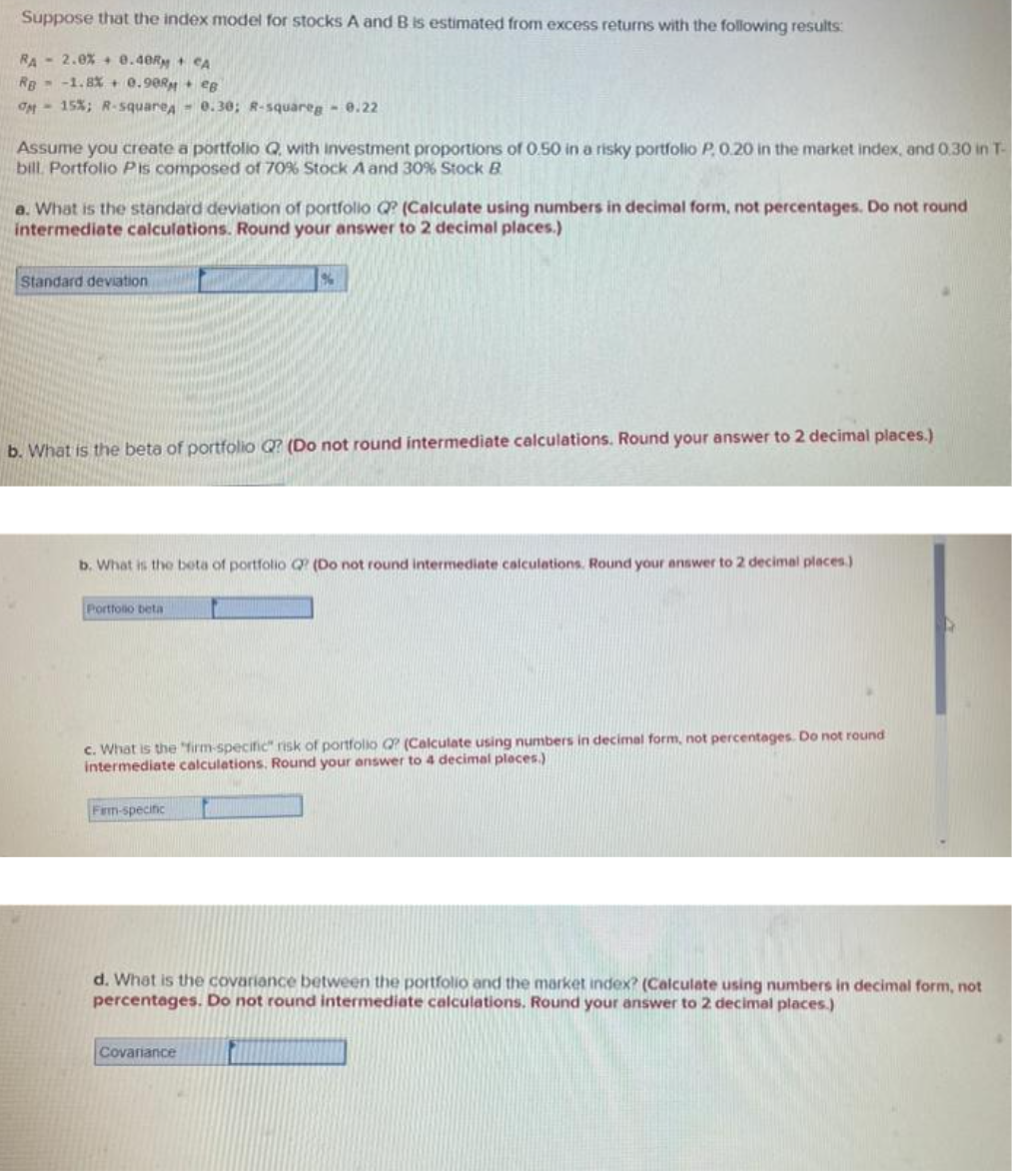

Suppose that the index model for stocks A and B is estimated from excess returns with the following results: RA - 2.0% 4 8.40 + A RB = -1.8%+0.98R. e - 15%; R-squares - 0.30; R-squareg - 0.22 Assume you create a portfolio Q. with investment proportions of 0.50 in a risky portfolio P. 0.20 in the market index, and 0.30 in T- bill Portfolio Pis composed of 70% Stock Aand 30% Stock B a. What is the standard deviation of portfolio Q? (Calculate using numbers in decimal form, not percentages. Do not round intermediate calculations. Round your answer to 2 decimal places.) Standard deviation b. What is the beta of portfolio Q? (Do not round intermediate calculations. Round your answer to 2 decimal places.) b. What is the bota of portfolio (Do not round intermediate calculations. Round your answer to 2 decimal places) Portfolio beta c. What is the firm specific risk of portfolio Q? (Calculate using numbers in decimal form, not percentages. Do not round intermediate calculations, Round your answer to 4 decimal places) Firm-specific d. What is the covariance between the portfolio and the market index? (Calculate using numbers in decimal form, not percentages. Do not round intermediate calculations. Round your answer to 2 decimal places.) Covariance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts