Question: solve oart 2 please , thank you! #1. (0.05 points) Part One: A Portuguese index spot is lo= 3,700.00 euros in derivative market. In the

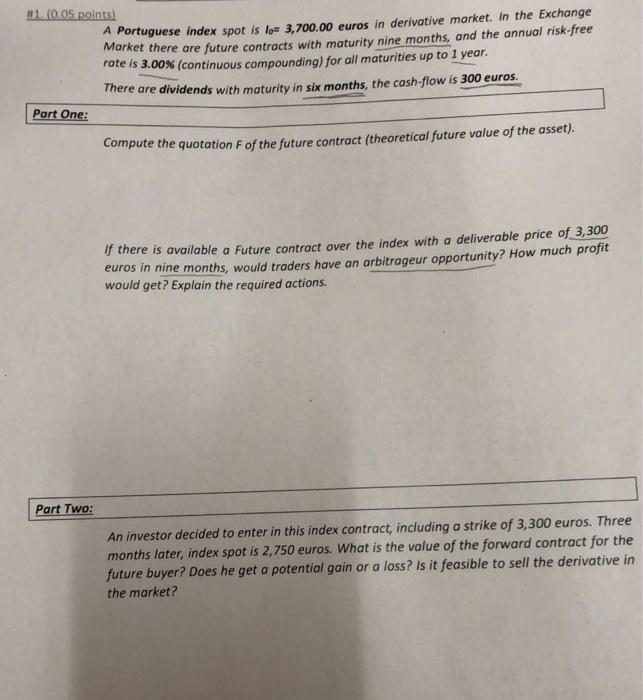

#1. (0.05 points) Part One: A Portuguese index spot is lo= 3,700.00 euros in derivative market. In the Exchange Market there are future contracts with maturity nine months, and the annual risk-free rate is 3.00% (continuous compounding) for all maturities up to 1 year. There are dividends with maturity in six months, the cash-flow is 300 euros. Compute the quotation F of the future contract (theoretical future value of the asset). If there is available a Future contract over the index with a deliverable price of 3,300 euros in nine months, would traders have an arbitrageur opportunity? How much profit would get? Explain the required actions. An investor decided to enter in this index contract, including a strike of 3,300 euros. Three months later, index spot is 2,750 euros. What is the value of the forward contract for the future buyer? Does he get a potential gain or a loss? Is it feasible to sell the derivative in the market? Part Two

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts