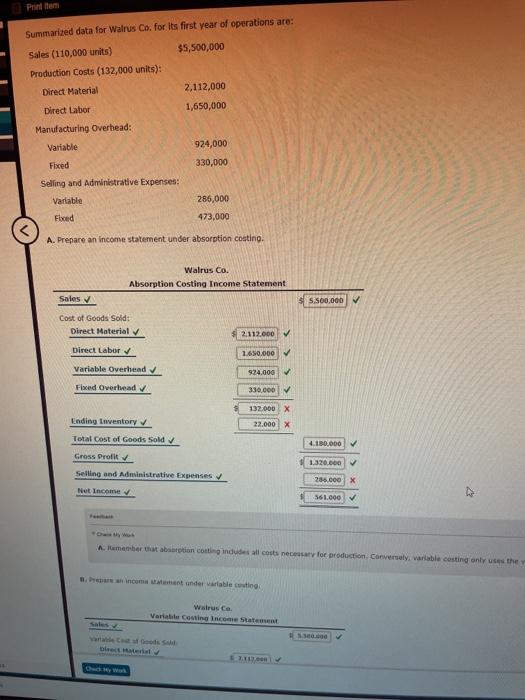

Question: Pri tem Summarized data for Walrus Co. for its first year of operations are: Sales (110,000 units) $5,500,000 Production Costs (132,000 units): Direct Material 2,112,000

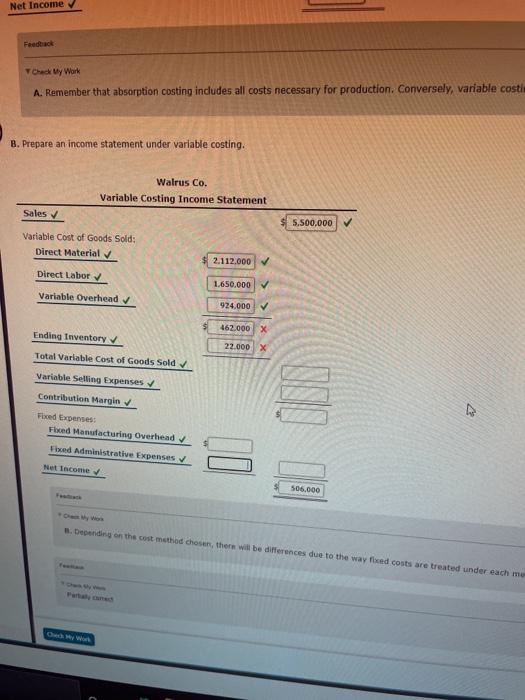

Pri tem Summarized data for Walrus Co. for its first year of operations are: Sales (110,000 units) $5,500,000 Production Costs (132,000 units): Direct Material 2,112,000 Direct Labor 1,650,000 Manufacturing Overhead: Variable 924,000 330,000 Fixed Selling and Administrative Expenses: Variable Food 286,000 473,000 A. Prepare an income statement under absorption costino. Walrus Co. Absorption Costing Income Statement Sales 5.500.000 Cost of Goods Sold: Direct Material 2.112.000 Direct Labor 1.650.000 Variable Overhead 924,000 Fixed Overhead 330.000 132.000 x 22.000 X 4.100.000 Ending Inventory Total Cost of Goods Sold Gross Profit Selling and Administrative Expenses Net Income 1.320.000 256.000 X 561.000 A. Remember that bortion conting indudes all costs necessary for production Conversely, valable casting only uses the wstrus C Vara Costing Income Statement 3. Net Income Feedback Check My Work A. Remember that absorption costing includes all costs necessary for production. Conversely, variable costi B. Prepare an income statement under variable costing. Walrus Co. Variable Costing Income Statement Sales 5.500.000 Variable Cost of Goods Sold: Direct Material 2.112.000 Direct Labor 1.650.000 Variable Overhead 924.000 462.000 x Ending Inventory 22.000 X Total Variable Cost of Goods Sold Variable Selling Expenses Contribution Margin OJO 7 Fried Expenses: Fbced Manufacturing Overhead Vored Administrative Expenses Net Income 506.000 Depending on the cost method chosen there will be differences due to the way fixed costs are treated under each me

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts