Question: Pringles Chips is considering to start a new production plan that will improve production efficiency. The plan requires a machine that costs $1,500,000 and will

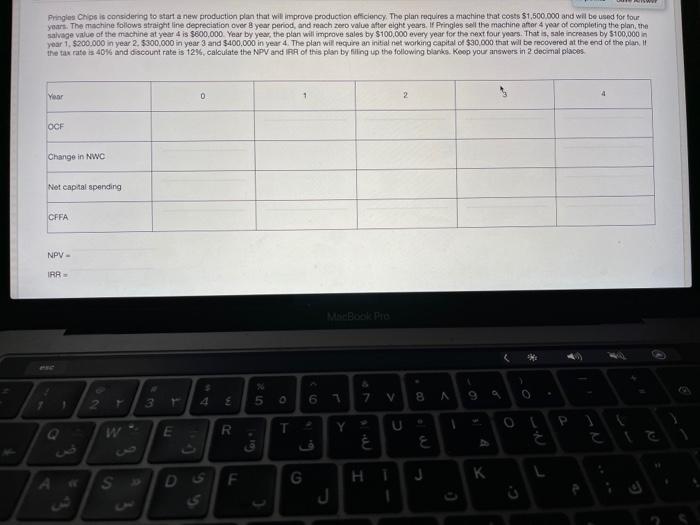

Pringles Chips is considering to start a new production plan that will improve production efficiency. The plan requires a machine that costs $1,500,000 and will be used for four years. The machine follows straight line depreciation over 8 year period and reach zero value after eight years. If Pringles sell the machine after 4 year of completing the plan, salvage value of the machine at year 4 is $800,000 Year by year, the plan will improve sales by $100.000 every year for the next four years. That is, sal increases by 5100,000 year 1. $200.000 in year 2. $300,000 in year 3 and $400,000 in year 4. The plan will require an initial networking capital of $30.000 that will be recovered at the end of the plan, It the tax rate is 40% and discount rate is 12%, calculate the NPV and IRR of this plan by filing up the following blanks. Koop your answers in 2 decimal places Mar 0 2 OCF Change in NWC Net capital spending CFFA NPV- IRR MACBOOK 3 4 E 5 9 6 V 1 7 8 A E R T lor E F G . S J

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts