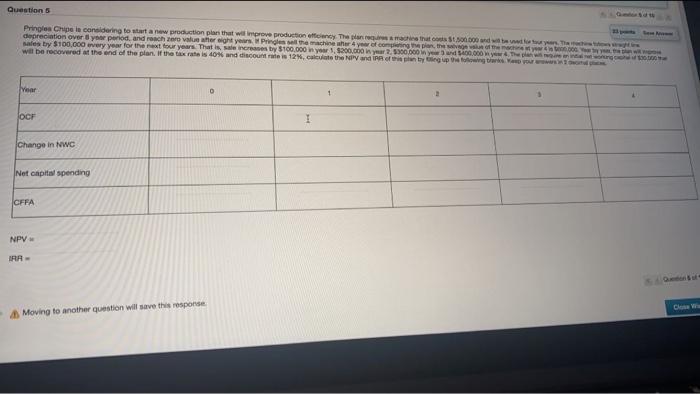

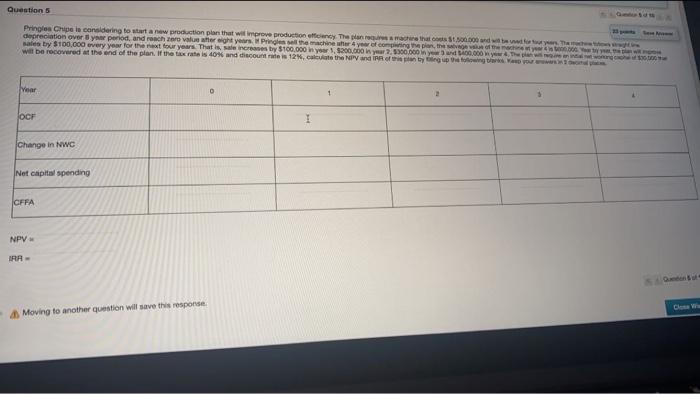

Question: Question 5 Pringles Chipe is considering to start a new production plans that will improve production of The machine that to dobar. The sales by

Question 5 Pringles Chipe is considering to start a new production plans that will improve production of The machine that to dobar. The sales by $100.000 every year for the four years. That is, sal increases by $100.000 in your 1.200.000 in year 2.500.000 wyward $400.000 y.The go will be recovered at the end of the plan. If the tax rate is 40% and discount rate is 12, cat the NPV and of this typowing are your ear D OCF I Change in wc Net capital spending CFFA NPV TRA- Moving to another question will save this response Question 5 Pringles Chipe is considering to start a new production plans that will prove production efficacy. The place that standswyer depreciation over your period, and rancher versight years, Pringles the machine 4 yw of coming on the other sale by $100.000 every year for the four years. That is, sale increases by $100.000 in your 1.200.000 in year 2.500.000 100.000 wyw. The will be recovered at the end of the plan. If the tax rate is 40% and discount rate is 12, cut the NPV and of by going to You Year D OCH Change in NWC Net capital spending CFFA NPV IRA- Cle Moving to another question will save this response Question 5 Pringles Chipe is considering to start a new production plans that will improve production of The machine that to dobar. The sales by $100.000 every year for the four years. That is, sal increases by $100.000 in your 1.200.000 in year 2.500.000 wyward $400.000 y.The go will be recovered at the end of the plan. If the tax rate is 40% and discount rate is 12, cat the NPV and of this typowing are your ear D OCF I Change in wc Net capital spending CFFA NPV TRA- Moving to another question will save this response Question 5 Pringles Chipe is considering to start a new production plans that will prove production efficacy. The place that standswyer depreciation over your period, and rancher versight years, Pringles the machine 4 yw of coming on the other sale by $100.000 every year for the four years. That is, sale increases by $100.000 in your 1.200.000 in year 2.500.000 100.000 wyw. The will be recovered at the end of the plan. If the tax rate is 40% and discount rate is 12, cut the NPV and of by going to You Year D OCH Change in NWC Net capital spending CFFA NPV IRA- Cle Moving to another question will save this response

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts