Question: PRINTER VERSION BACK NEXT Multiple Choice Question 97 Data for Hugh's Corporation is provided below. Hugh's recently acquired some risky assets that caused Its beta

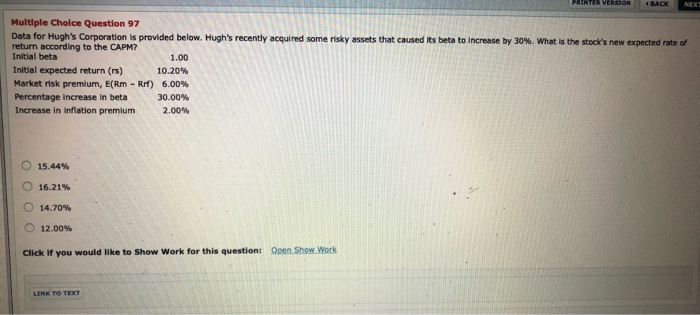

PRINTER VERSION BACK NEXT Multiple Choice Question 97 Data for Hugh's Corporation is provided below. Hugh's recently acquired some risky assets that caused Its beta to increase by 30%. What is the stock's new expected rate of return according to the CAPM? Initial beta 1.00 Initial expected return (rs) 10.20% Market risk premium, E(Rm - Rif) 6.00% Percentage increase in beta 30.00% Increase in inflation premium 2.00% O 15.44% O 16.21% O 14.70% O 12.00% Click If you would like to Show Work for this question: Open Show Work LINK TO TEXT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts