Question: PRINTER VERSION BACK NEXT Problem 9.10 Sheridan Corp. paid a dividend of $2.32 yesterday. The company's dividend is expected to grow at a steady rate

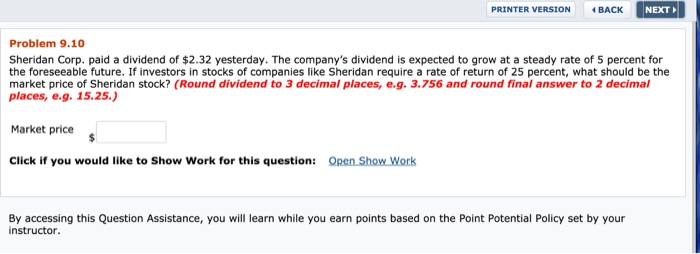

PRINTER VERSION BACK NEXT Problem 9.10 Sheridan Corp. paid a dividend of $2.32 yesterday. The company's dividend is expected to grow at a steady rate of 5 percent for the foreseeable future. If investors in stocks of companies like Sheridan require a rate of return of 25 percent, what should be the market price of Sheridan stock? (Round dividend to 3 decimal places, e.g. 3.756 and round final answer to 2 decimal places, e.g. 15.25.) Market price Click if you would like to Show Work for this question: Open Show Work By accessing this Question Assistance, you will learn while you earn points based on the Point Potential Policy set by your instructor

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts