Question: PRINTER VERSION BACK Problem 10.16 a-b (Solution Video) Crane Industries is expanding its product line and its production capacity. The costs and expected cash flows

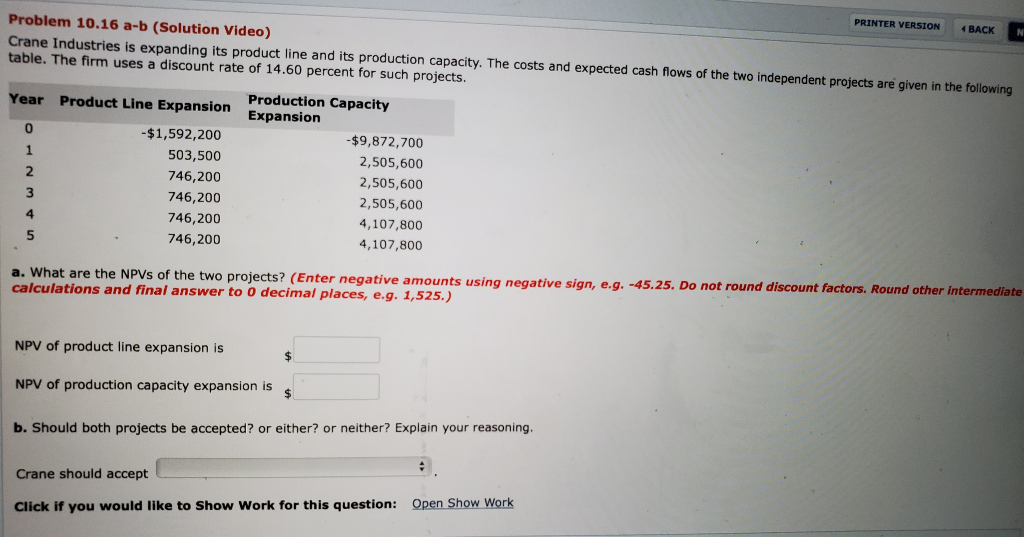

PRINTER VERSION BACK Problem 10.16 a-b (Solution Video) Crane Industries is expanding its product line and its production capacity. The costs and expected cash flows of the two independent projects are given in the following table. The firm uses a discount rate of 14.60 percent for such projects. Year Product Line Expansion -$1,592,200 503,500 746,200 746,200 746,200 746,200 AWNO Production Capacity Expansion -$9,872,700 2,505,600 2,505,600 2,505,600 4,107,800 4,107,800 a. What are the NPVs of the two projects? (Enter negative amounts using negative sign, e.g. -45.25. Do not round discount factors. Round other intermediate calculations and final answer to o decimal places, e.g. 1,525.) NPV of product line expansion is NPV of production capacity expansion is a b. Should both projects be accepted? or either? or neither? Explain your reasoning, Crane should accept Click if you would like to Show Work for this question: Open Show Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts