Question: Problem 10.16 a-b (Solution Video) Ivanhoe Industries is expanding its product line and its production capacity. The costs and expected cash flows of the two

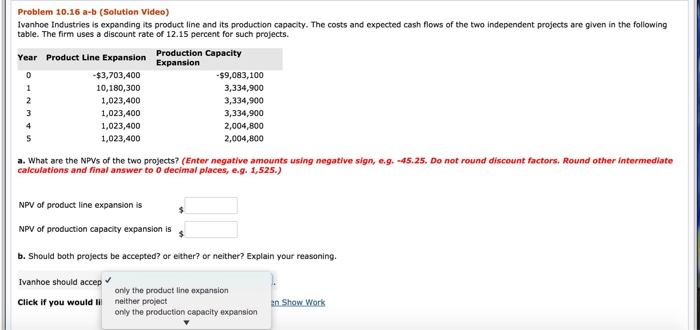

Problem 10.16 a-b (Solution Video) Ivanhoe Industries is expanding its product line and its production capacity. The costs and expected cash flows of the two independent projects are given in the following table. The firm uses a discount rate of 12.15 percent for such projects. Year Product Line Expansion -$3,703,400 10,180,300 1,023,400 1,023,400 1,023,400 1,023,400 Production Capacity Expansion -$9,083,100 3,334,900 3,334,900 3,334,900 2,004,800 2,004,800 a. What are the NPVs of the two projects? (Enter negative amounts using negative sign, e.g.-45.25. Do not round discount factors. Round other intermediate calculations and final answer to o decimal places, e.g. 1,525.) NPV of product line expansion is NPV of production capacity expansion is b. Should both projects be accepted? or either? or neither? Explain your reasoning. Ivanhoe should accep Click if you would lil only the product line expansion neither project only the production capacity expansion en Show Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts