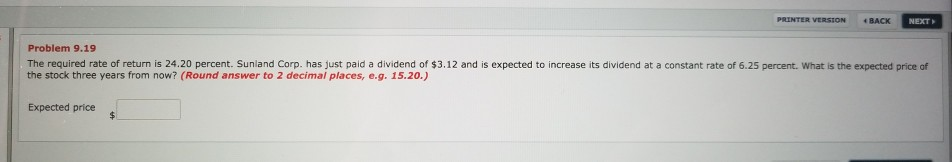

Question: PRINTER VSION 4 BACK NEXT Problem 9.19 The required rate of return is 24.20 percent. Sunland Corp. has just paid a dividend of $3.12 and

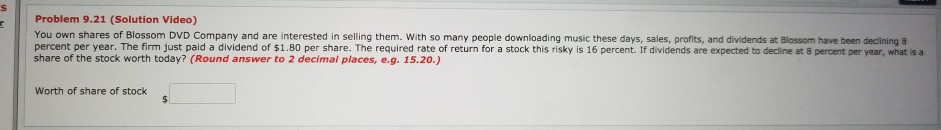

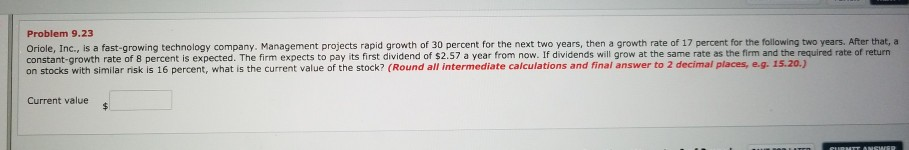

PRINTER VSION 4 BACK NEXT Problem 9.19 The required rate of return is 24.20 percent. Sunland Corp. has just paid a dividend of $3.12 and is expected to increase its dividend at a constant rate of 6.25 percent. What is the expected price of the stock three years from now? (Round answer to 2 decimal places, e.g. 15.20.) Expected price Problem 9.21 (Solution Video) You own shares of Blossom DVD Company and are interested in selling them. With so many people downloading music these days, sales, profits, and dividends at Blossom have been declining 8 percent per year. The firm just paid a dividend of $1.80 per share. The required rate of return for a stock this risky is 16 percent. If dividends are expected to decline at 8 percent per year, what is a share of the stock worth today? (Round answer to 2 decimal places, e.g. 15.20.) Worth of share of stock Problem 9.23 Oriole, Inc., is a fast-growing technology company. Management projects rapid growth of 30 percent for the next two years, then a growth rate of 17 percent for the following two years. After that, a constant-growth rate of 8 percent is expected. The firm expects to pay its first dividend of $2.57 a year from now. If dividends will grow at the same rate as the firm and the required rate of return on stocks with similar risk is 16 percent, what is the current value of the stock? (Round all intermediate calculations and final answer to 2 decimal places, e.g. 15.20.) Current value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts