Question: Prior to beginning work on this discussion, please read the article Capital Investment Appraisal Techniques: A Survey of Current Usage by Sangster (1993). After setting

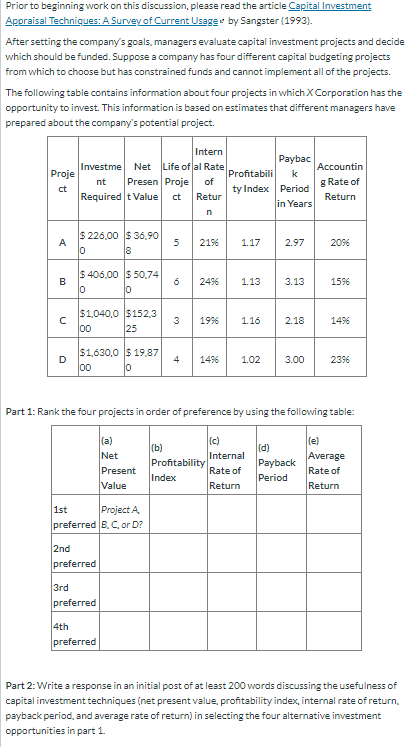

Prior to beginning work on this discussion, please read the article Capital Investment Appraisal Techniques: A Survey of Current Usage by Sangster (1993). After setting the company's goals, managers evaluate capital investment projects and decide which should be funded. Suppose a company has four different capital budgeting projects from which to choose but has constrained funds and cannot implement all of the projects. The following table contains information about four projects in which X Corporation has the opportunity to invest. This information is based on estimates that different managers have prepared about the company's potential project Intern Paybac Investme Proje Life of al Rate Net Accountin Profitabili of k Presen Proje g Rate of nt ty Index Period ct Required t Value Return Retur ct in Years n $ 226,00 $36,90 A 5 219% 1.17 2,97 20% 8 $ 406.00 $ 50.74 249% 1.13 3.13 15% 0 C $1,040,0 $152,3 C 3 1996 1.16 2.18 1496 00 25 $1,630,0 $19,87 4 14 % 1.02 3.00 23% 00 lo Part 1: Rank the four projects in order of preference by using the following table: (c) (a) el (b) Profitability (d) Payback Period Internal Average Net Rate of Rate of Present Index Value Return Return 1st Project A preferred B, C. or D? 2nd preferred 3rd preferred 4th preferred Part 2: Write a response in an initial post of at least 200 words discussing the usefulness of capital investment techniques (net present value, profitability index, internal rate of return, payback period, and average rate of return) in selecting the four alternative investment opportunities in part 1 C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts