Question: Prior to making its annual year end adjusting entry for Bad Debt Expense (Doubtful Accounts Expense) at December 31, 2019, Certainty Company had an account

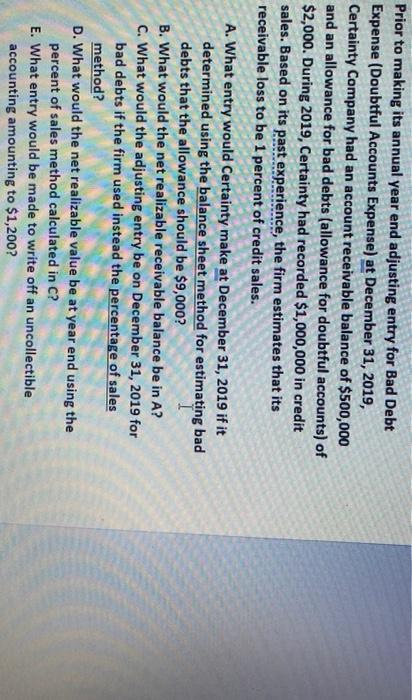

Prior to making its annual year end adjusting entry for Bad Debt Expense (Doubtful Accounts Expense) at December 31, 2019, Certainty Company had an account receivable balance of $500,000 and an allowance for bad debts (allowance for doubtful accounts) of $2,000. During 2019, Certainty had recorded $1,000,000 in credit sales. Based on its past experience, the firm estimates that its receivable loss to be 1 percent of credit sales. A. What entry would certainty make at December 31, 2019 if it determined using the balance sheet method for estimating bad debts that the allowance should be $9,000? B. What would the net realizable receivable balance be in A? C. What would the adjusting entry be on December 31, 2019 for bad debts if the firm used instead the percentage of sales method? D. What would the net realizable value be at year end using the percent of sales method calculated in C? E. What entry would be made to write off an uncollectible accounting amounting to $1,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts