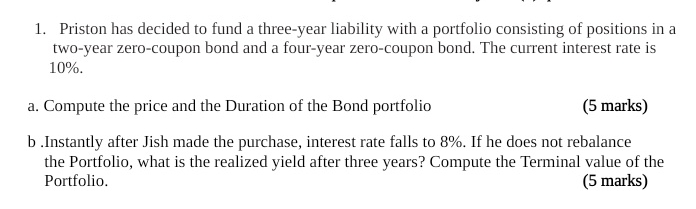

Question: Priston has decided to fund a three - year liability with a portfolio consisting of positions in a two - year zero - coupon bond

Priston has decided to fund a threeyear liability with a portfolio consisting of positions in a twoyear zerocoupon bond and a fouryear zerocoupon bond. The current interest rate is

a Compute the price and the Duration of the Bond portfolio

marks

b Instantly after Jish made the purchase, interest rate falls to If he does not rebalance the Portfolio, what is the realized yield after three years? Compute the Terminal value of the Portfolio.

marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock