Question: Pro forma balance sheet-Basic Leonard Industries wishes to prepare a pro forma balance sheet for December 31,2020 . The firm expects 2020 sales to total

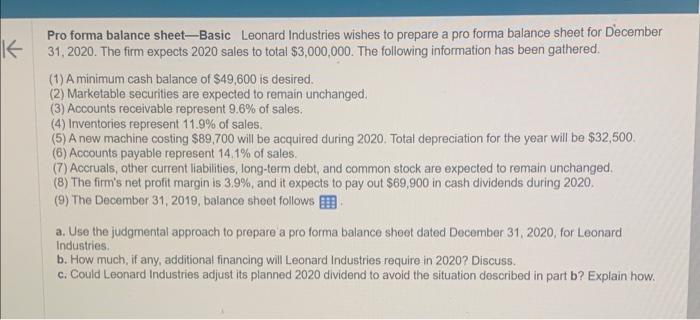

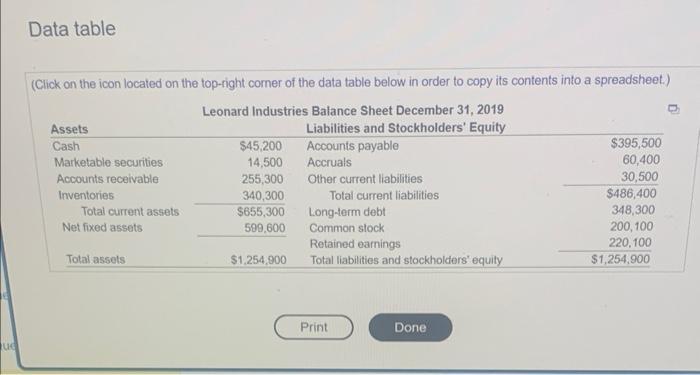

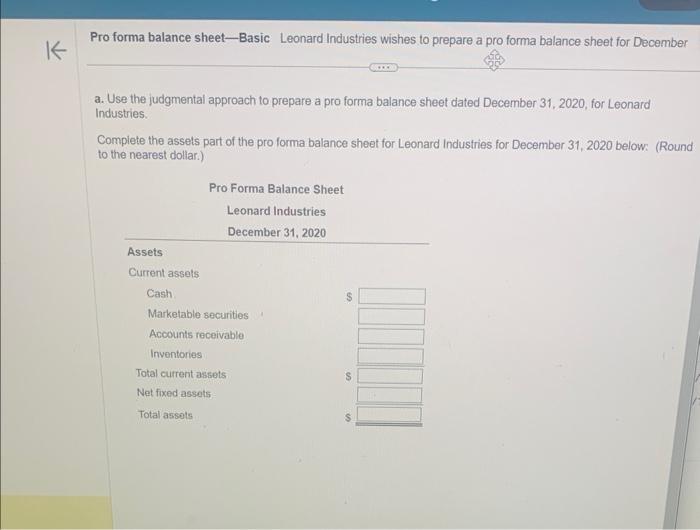

Pro forma balance sheet-Basic Leonard Industries wishes to prepare a pro forma balance sheet for December 31,2020 . The firm expects 2020 sales to total $3,000,000. The following information has been gathered. (1) A minimum cash balance of $49,600 is desired. (2) Marketable securities are expected to remain unchanged. (3) Accounts receivable represent 9.6% of sales. (4) Inventories represent 11.9% of sales. (5) A new machine costing $89,700 will be acquired during 2020. Total depreciation for the year will be $32,500. (6) Accounts payable represent 14.1% of sales. (7) Accruals, other current liabilities, long-term debt, and common stock are expected to remain unchanged. (8) The firm's net profit margin is 3.9%, and it expects to pay out $69,900 in cash dividends during 2020. (9) The December 31,2019 , balance sheet follows a. Use the judgmental approach to prepare a pro forma balance sheet dated December 31, 2020, for Leonard Industries. b. How much, if any, additional financing will Leonard Industries require in 2020 ? Discuss. c. Could Leonard Industries adjust its planned 2020 dividend to avoid the situation described in part b? Explain how. Data table (Click on the icon located on the top-right comer of the data table below in order to copy its contents into a spreadsheet.) Pro forma balance sheet-Basic Leonard Industries wishes to prepare a pro forma balance sheet for December a. Use the judgmental approach to prepare a pro forma balance sheet dated December 31, 2020, for Leonard Industries. Complete the assets part of the pro forma balance sheet for Leonard Industries for December 31,2020 below: (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts