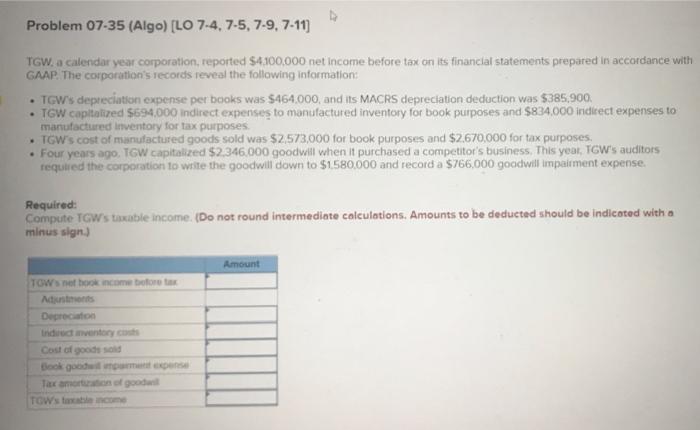

Question: Problem 07-35 (Algo) [LO 7-4, 7-5, 7-9, 7-11) TGW. a calendar year corporation, reported 54 100.000 net income before tax on its financial statements prepared

Problem 07-35 (Algo) [LO 7-4, 7-5, 7-9, 7-11) TGW. a calendar year corporation, reported 54 100.000 net income before tax on its financial statements prepared in accordance with GAAP. The corporation's records reveal the following information TGW depreciation expense per books was 5464.000, and its MACRS depreciation deduction was $385,900 TGW capitalized $694.000 indirect expenses to manufactured inventory for book purposes and $834.000 indirect expenses to manufactured inventory for tax purposes TGW's cost of manufactured goods sold was $2,573,000 for book purposes and $2,670,000 for tax purposes. . Four years ago. TGW capitalized $2,346,000 goodwill when it purchased a competitor's business. This year, TGW's auditors required the corporation to write the goodwill down to $1580.000 and record a $766,000 goodwill impairment expense. Required: Compute TGW's taxable income. (Do not round intermediate calculations. Amounts to be deducted should be indicated with a minus sign.) Amount TOWnetbook income for tax Adjustments Deprecato Indud vento con Cost of goods sold Book goodwill mense Tax amount good TGW's taxable income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts