Question: please include work i would like to understand! thank you Problem 07-35 (Algo) (LO 7-4, 7-5, 7-9, 7-11) . . TGW, a calendar year corporation,

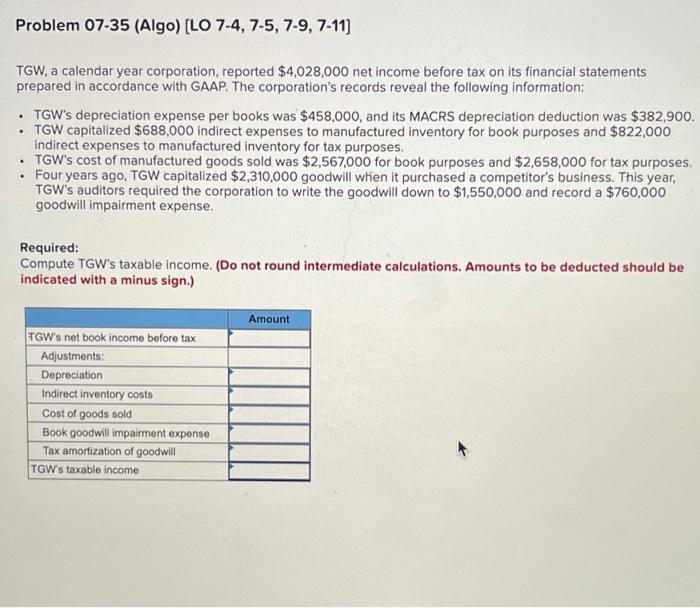

Problem 07-35 (Algo) (LO 7-4, 7-5, 7-9, 7-11) . . TGW, a calendar year corporation, reported $4,028,000 net income before tax on its financial statements prepared in accordance with GAAP. The corporation's records reveal the following information: TGW's depreciation expense per books was $458,000, and its MACRS depreciation deduction was $382,900. TGW capitalized $688,000 indirect expenses to manufactured inventory for book purposes and $822,000 indirect expenses to manufactured inventory for tax purposes. TGW's cost of manufactured goods sold was $2,567,000 for book purposes and $2,658,000 for tax purposes. Four years ago, TGW capitalized $2,310,000 goodwill when it purchased a competitor's business. This year, TGW's auditors required the corporation to write the goodwill down to $1,550,000 and record a $760,000 goodwill impairment expense. . Required: Compute TGW's taxable income. (Do not round intermediate calculations. Amounts to be deducted should be indicated with a minus sign.) Amount TGW's net book income before tax Adjustments: Depreciation Indirect inventory costs Cost of goods sold Book goodwill impairment expense Tax amortization of goodwill TGW's taxable income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts