Question: Problem 1 0 - 2 8 ( LO . 2 ) In the current year, Roger pays a ( $ 9 , 0

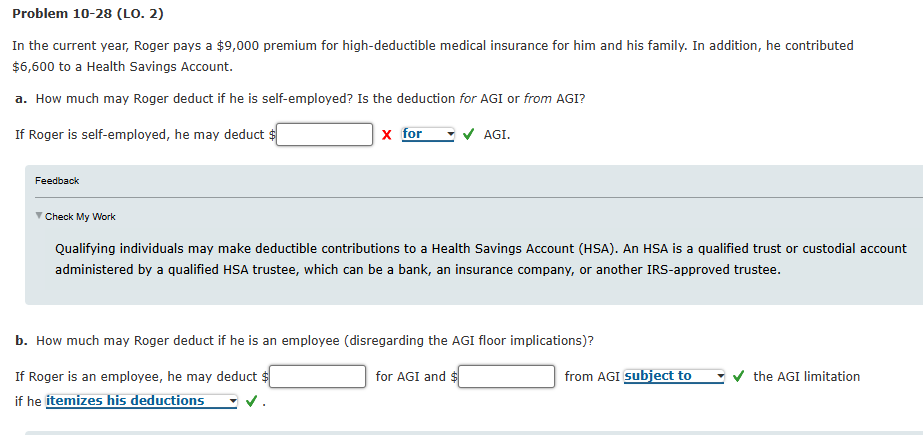

Problem LO In the current year, Roger pays a $ premium for highdeductible medical insurance for him and his family. In addition, he contributed $ to a Health Savings Account. a How much may Roger deduct if he is selfemployed? Is the deduction for AGI or from AGI? If Roger is selfemployed, he may deduct $ Feedback Check My Work Qualifying individuals may make deductible contributions to a Health Savings Account HSA An HSA is a qualified trust or custodial account administered by a qualified HSA trustee, which can be a bank, an insurance company, or another IRSapproved trustee. b How much may Roger deduct if he is an employee disregarding the AGI floor implications If Roger is an employee, he may deduct $ for AGI and $ from AGI the AGI limitation if he itemizes his deductions checkmark

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock