Question: Problem 10-28 (Algorithmic) (LO. 2) In the current year, Roger pays a $2,500 premium for high-deductible medical insurance for him and his family. In addition,

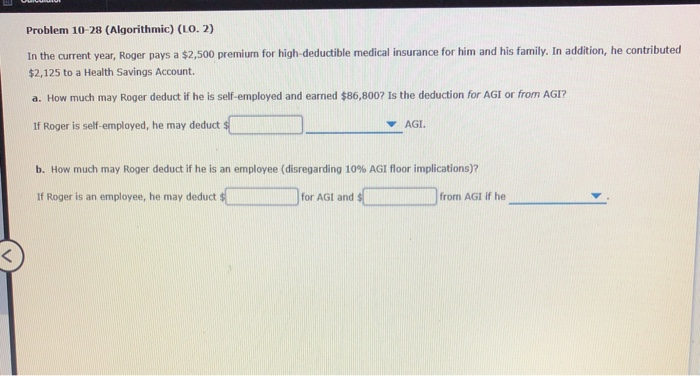

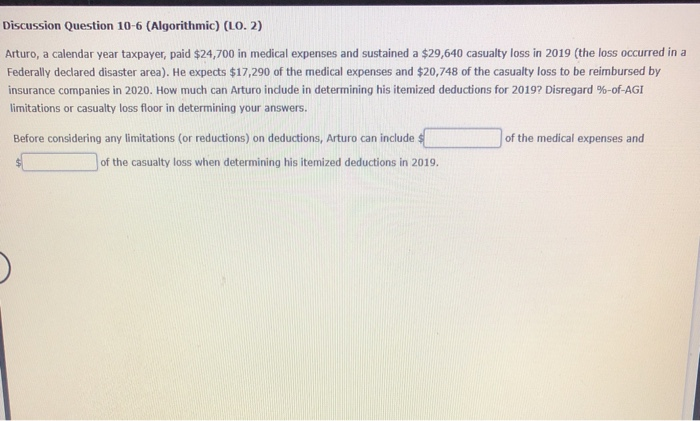

Problem 10-28 (Algorithmic) (LO. 2) In the current year, Roger pays a $2,500 premium for high-deductible medical insurance for him and his family. In addition, he contributed $2,125 to a Health Savings Account a. How much may Roger deduct if he is self-employed and earned $86,800? Is the deduction for AGI or from AGI? If Roger is self-employed, he may deduct $ AGI. b. How much may Roger deduct if he is an employee (disregarding 10% AGI floor implications)? If Roger is an employee, he may deduct $ for AGt and s from AG if he Discussion Question 10-6 (Algorithmic) (L0.2) Arturo, a calendar year taxpayer, paid $24,700 in medical expenses and sustained a $29,640 casualty loss in 2019 (the loss occurred in a Federally declared disaster area). He expects $17,290 of the medical expenses and $20,748 of the casu insurance companies in 2020. How much can Arturo include in determining his itemized deductions for 2019? Disregard %-of-AGI limitations or casualty loss floor in determining your answers. of the medical expenses and Before considering any limitations (or reductions) on deductions, Arturo can include of the casualty loss when determining his itemized deductions in 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts