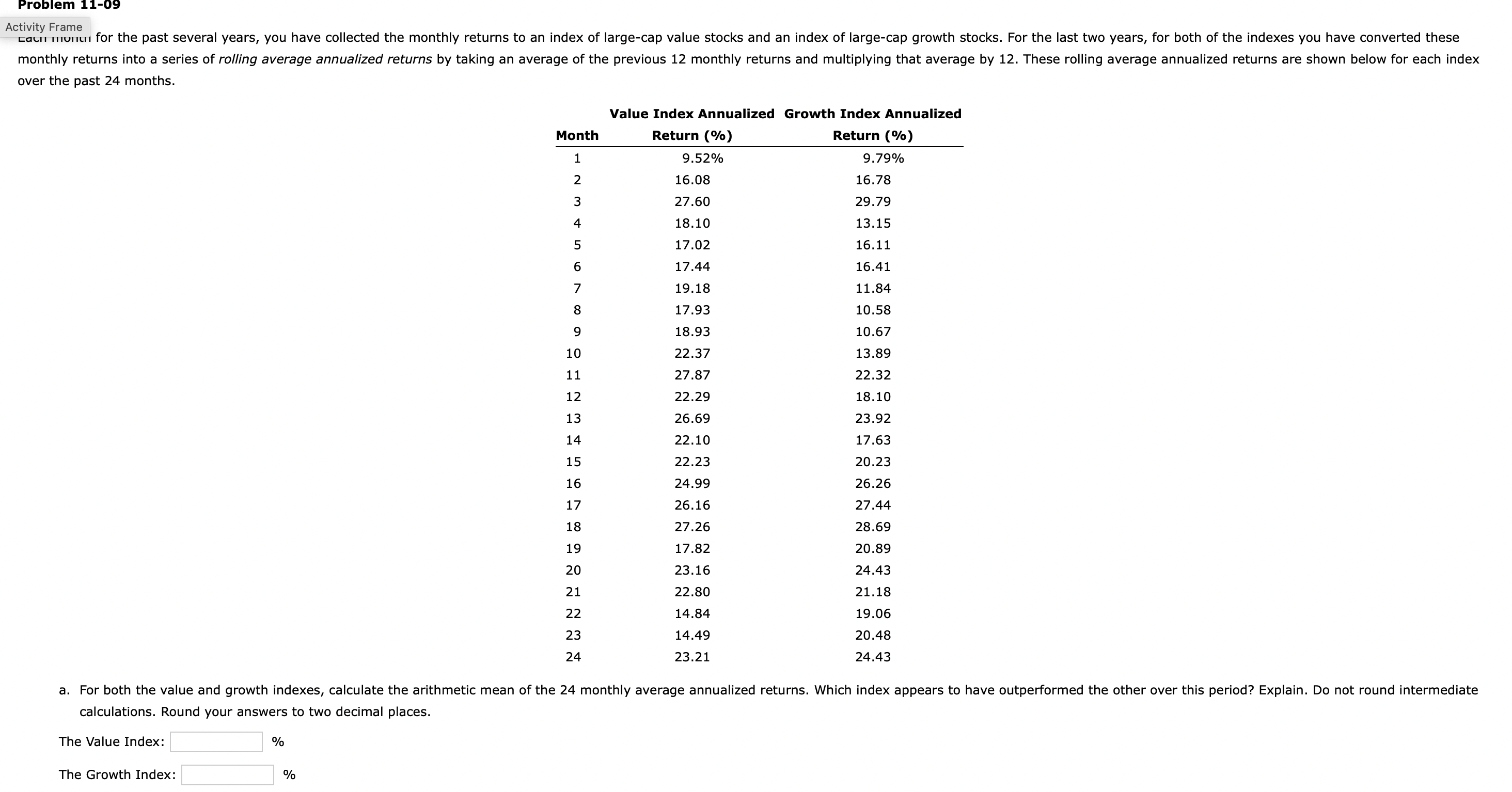

Question: Problem 1 1 - 0 9 Activity Frame over the past 2 4 months. Value Index Annualized Growth Index Annualized calculations. Round your answers to

Problem

Activity Frame over the past months.

Value Index Annualized Growth Index Annualized calculations. Round your answers to two decimal places.

The Value Index:

The Growth Index: answers from part a Do not round intermediate calculations. Round your answers to two decimal places. Negative values, if any, should be indicated by a minus sign. If your answer is zero, enter

The average of the return in the differential series is Select the difference in the arithmetic means. The correct graph is

Activity Frame indicated by a minus sign.

A hedge fund that was following a strategy to go long in value stocks and short in growth stocks would Selectquite profitable. The hedge fund would have Selectthe average annualized return in the Value Index of thus it the additional risk premium of Round your answers to two decimal places.

What, if anything, does this tell you about the reliability of the value risk premium over time?

This means that the value risk premium of

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock