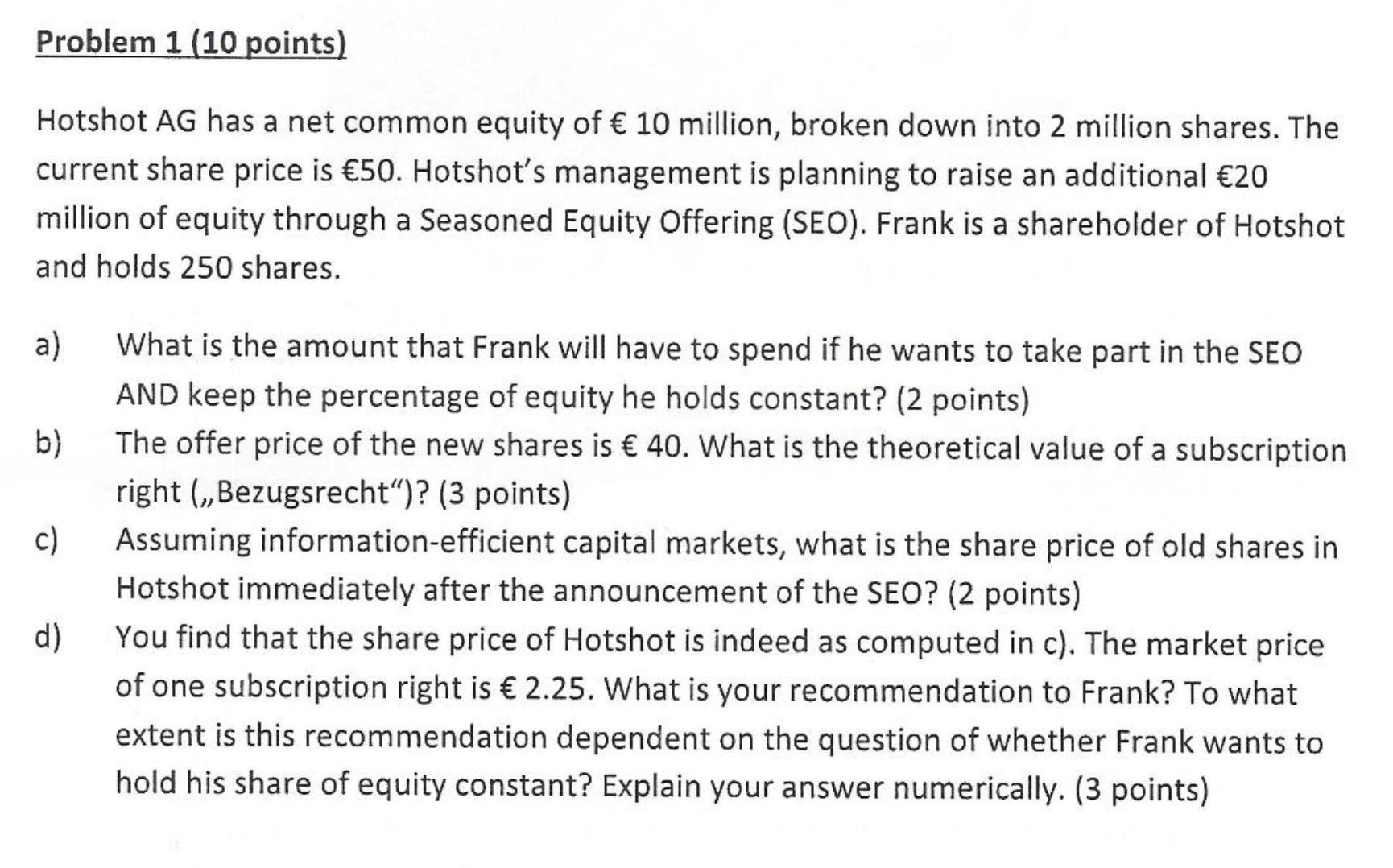

Question: Problem 1 ( 1 0 points ) Hotshot AG has a net common equity of ( 1 0 ) million, broken down into

Problem points Hotshot AG has a net common equity of million, broken down into million shares. The current share price is Hotshot's management is planning to raise an additional million of equity through a Seasoned Equity Offering SEO Frank is a shareholder of Hotshot and holds shares. a What is the amount that Frank will have to spend if he wants to take part in the SEO AND keep the percentage of equity he holds constant? points b The offer price of the new shares is What is the theoretical value of a subscription right Bezugsrecht points c Assuming informationefficient capital markets, what is the share price of old shares in Hotshot immediately after the announcement of the SEO? points d You find that the share price of Hotshot is indeed as computed in c The market price of one subscription right is What is your recommendation to Frank? To what extent is this recommendation dependent on the question of whether Frank wants to hold his share of equity constant? Explain your answer numerically. points

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock