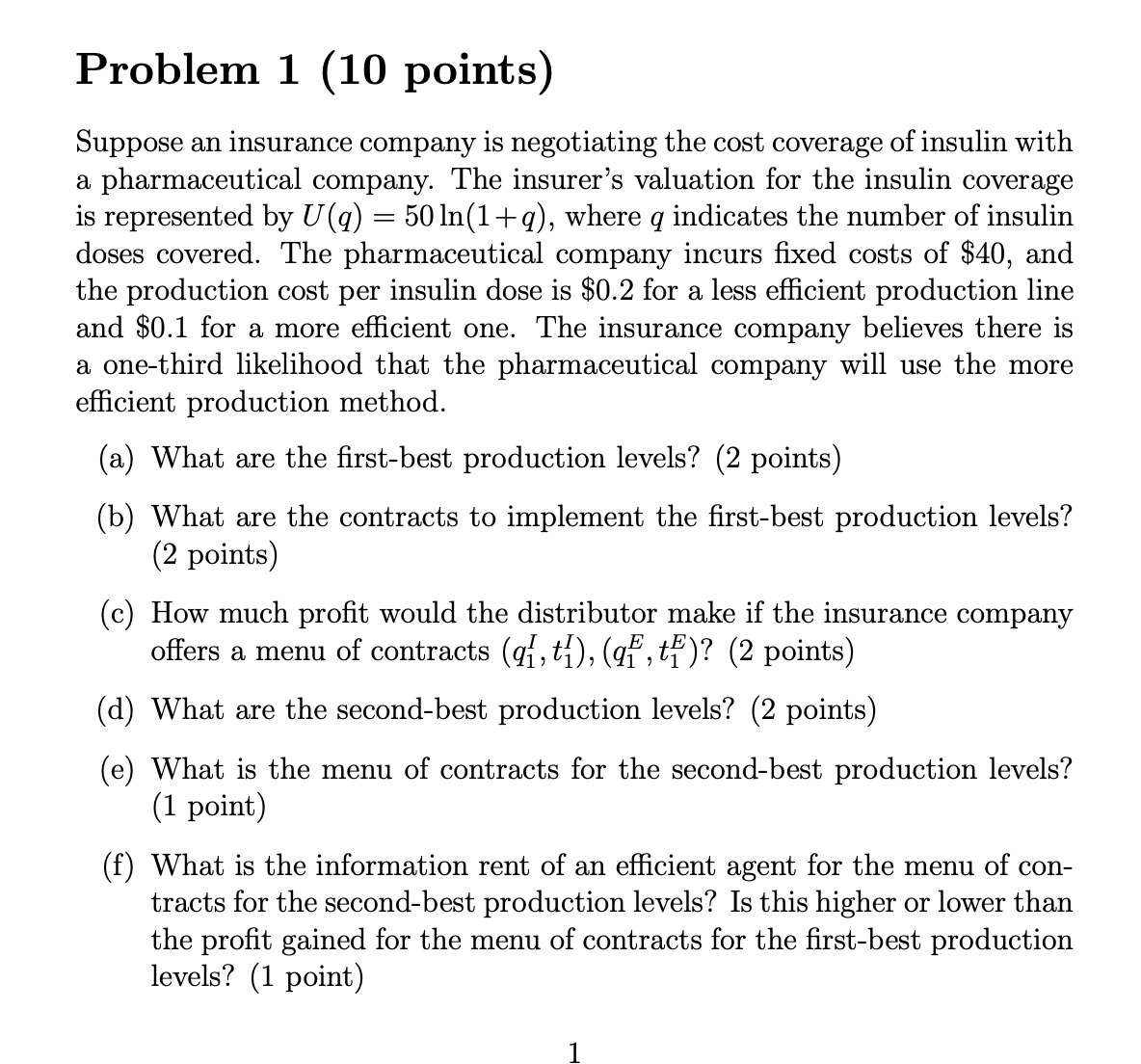

Question: Problem 1 ( 1 0 points ) Suppose an insurance company is negotiating the cost coverage of insulin with a pharmaceutical company. The insurer's valuation

Problem points

Suppose an insurance company is negotiating the cost coverage of insulin with

a pharmaceutical company. The insurer's valuation for the insulin coverage

is represented by where indicates the number of insulin

doses covered. The pharmaceutical company incurs fixed costs of $ and

the production cost per insulin dose is $ for a less efficient production line

and $ for a more efficient one. The insurance company believes there is

a onethird likelihood that the pharmaceutical company will use the more

efficient production method.

a What are the firstbest production levels? points

b What are the contracts to implement the firstbest production levels?

points

c How much profit would the distributor make if the insurance company

offers a menu of contracts points

d What are the secondbest production levels? points

e What is the menu of contracts for the secondbest production levels?

point

f What is the information rent of an efficient agent for the menu of con

tracts for the secondbest production levels? Is this higher or lower than

the profit gained for the menu of contracts for the firstbest production

levels? point

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock