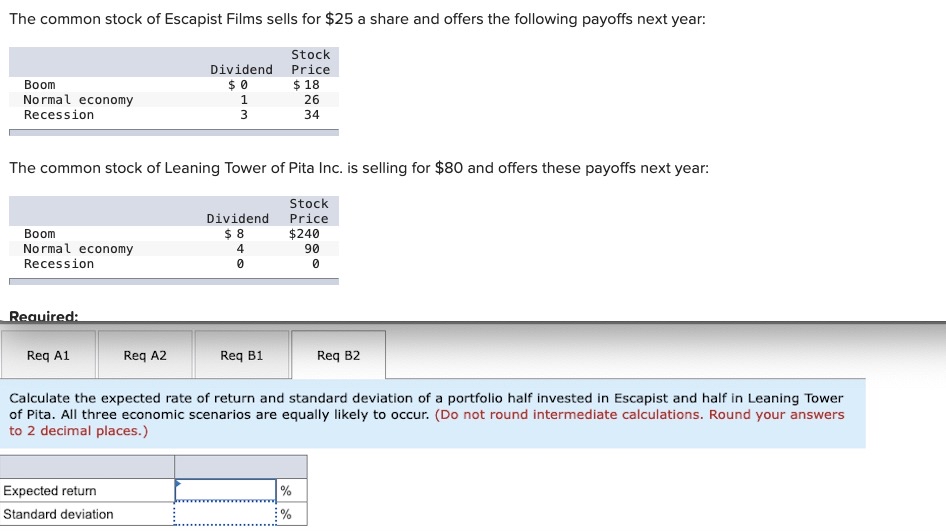

Question: Problem 1 1 - 1 5 Scenario Analysis and Portfolio Risk ( LO 2 , 3 ) The common stock of Leaning Tower of Pita

Problem Scenario Analysis and Portfolio Risk LOThe common stock of Leaning Tower of Pita Inc., a restaurant chain, will generate payoffs to investors next year, which depend on the state of the economy, as follows: Calculate the expected rate of return and standard deviation of a portfolio half invested in Escapist and half in Leaning Tower of Pita. All three economic scenarios are equally likely to occur. Do not round intermediate calculations. Round your answers to decimal places.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock