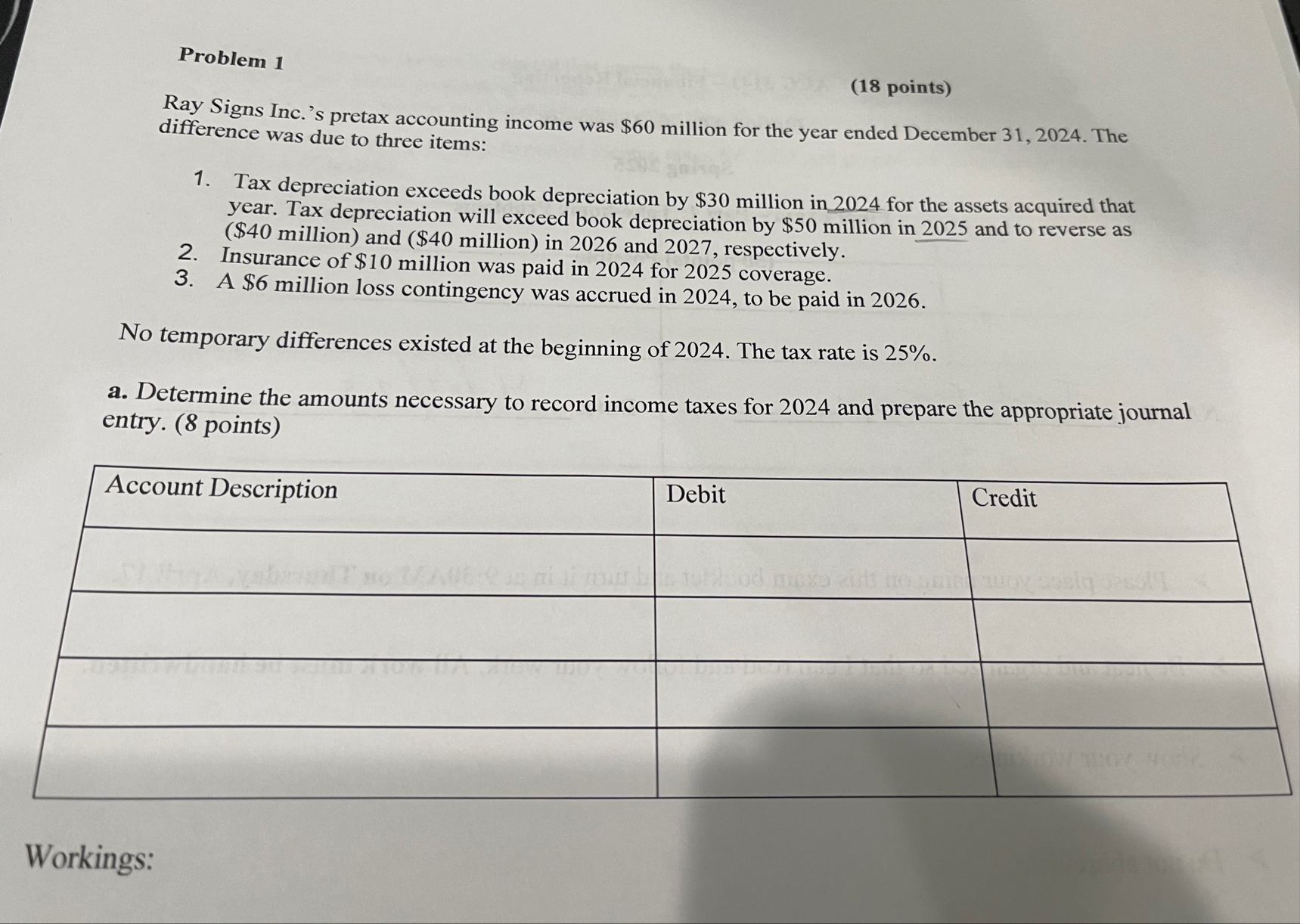

Question: Problem 1 ( 1 8 points ) Ray Signs Inc. ' s pretax accounting income was $ 6 0 million for the year ended December

Problem

points

Ray Signs Inc.s pretax accounting income was $ million for the year ended December The difference was due to three items:

Tax depreciation exceeds book depreciation by $ million in for the assets acquired that year. Tax depreciation will exceed book depreciation by $ million in and to reverse as $ million and $ million in and respectively.

Insurance of $ million was paid in for coverage.

A $ million loss contingency was accrued in to be paid in

No temporary differences existed at the beginning of The tax rate is

a Determine the amounts necessary to record income taxes for and prepare the appropriate journal entry. points

tableAccount Description,Debit,Credit

Workings:

b During a new tax law is enacted that causes the tax rate to change from to starting in Ray Signs' pretax accounting income for was $ million. There were no differences between accounting income and taxable income other than those described above.

Determine the amounts necessary to record income taxes for and prepare the appropriate journal entryentries points

tableAccount Description,Debit,Credit

c Assuming Ray Signs will show a single noncurrent net amount in its December balance sheet, indicate that amount and whether it is a net deferred tax asset or liability. points

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock