Question: Tax Return Problem 6 Please use 2 0 2 4 tax law. Required: Use the following information to complete Bob and Melissa Grant's 2 0

Tax Return Problem

Please use tax law.

Required:

Use the following information to complete Bob and Melissa Grant's foderal income tax return. If any information is missing, use reasonable assamptions to fill in the gaps.

The forms, schedales, and instructions can be found at the IRS website wwwirsgon The instructions can be belpful in completing the foems.

Facts:

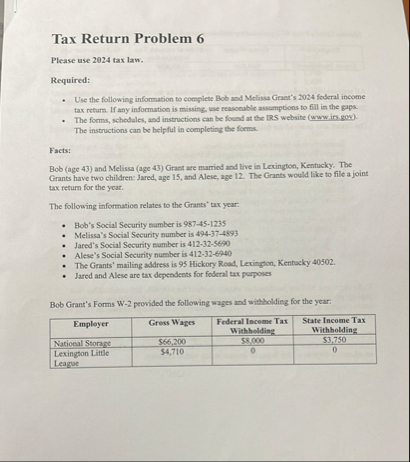

Bob age and Melissa age Grant are marriod and live in Lexington, Kentucky. The Grants have two children: Jared, age and Alese, age The Grants would like to file a joint tax return for the year.

The following information relates to the Grants' tax year:

Bob's Social Security eamber is

Melissa's Social Security number is

Jared's Social Security number is

Alese's Social Sccurity number is

The Grants' mailing address is Hickory Road, Lexington, Kennocky

Jared and Alese are tax dependents for fodernl ux purposes

Bob Grant's Forms W provided the following wages and withbolding for the year:

tableEmployerGress Wages,tableFederal Income TaxWirtholdingtableState Income TaxWithholdingNasional Stornge,$$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock