Question: Problem 1 (10 marks): On January 1, 2018, Griffiths Ltd. purchased 30% of the outstanding voting shares of Lee Enterprises for $230,000. Lee's Balance Sheet

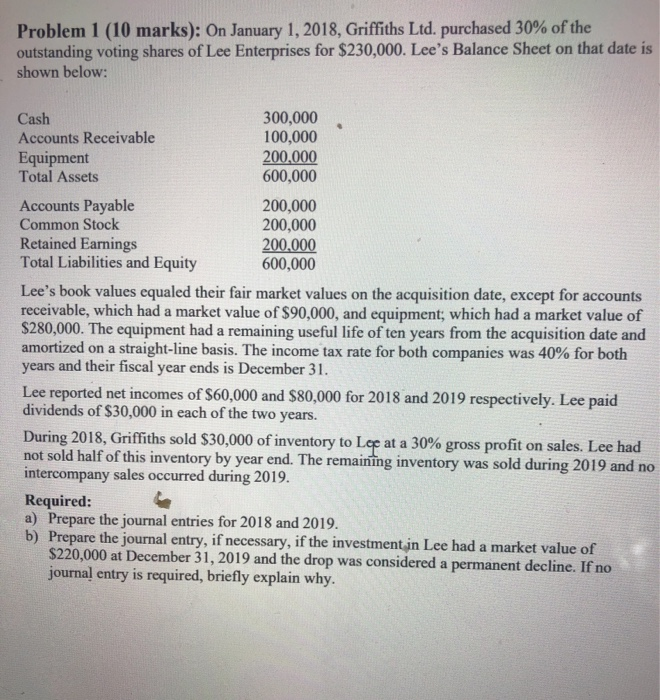

Problem 1 (10 marks): On January 1, 2018, Griffiths Ltd. purchased 30% of the outstanding voting shares of Lee Enterprises for $230,000. Lee's Balance Sheet on that date is shown below: Cash 300,000 Accounts Receivable 100,000 Equipment 200,000 Total Assets 600,000 Accounts Payable 200,000 Common Stock 200,000 Retained Earnings 200.000 Total Liabilities and Equity 600,000 Lee's book values equaled their fair market values on the acquisition date, except for accounts receivable, which had a market value of $90,000, and equipment, which had a market value of $280,000. The equipment had a remaining useful life of ten years from the acquisition date and amortized on a straight-line basis. The income tax rate for both companies was 40% for both years and their fiscal year ends is December 31. Lee reported net incomes of $60,000 and $80,000 for 2018 and 2019 respectively. Lee paid dividends of $30,000 in each of the two years. During 2018, Griffiths sold $30,000 of inventory to Loe at a 30% gross profit on sales. Lee had not sold half of this inventory by year end. The remaining inventory was sold during 2019 and no intercompany sales occurred during 2019. Required: a) Prepare the journal entries for 2018 and 2019. b) Prepare the journal entry, if necessary, if the investment in Lee had a market value of $220,000 at December 31, 2019 and the drop was considered a permanent decline. If no journal entry is required, briefly explain why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts