Question: Problem 1 (10 Points): Compute the following Ratios based upon the financial statements provided below (1 Point Each): 1.) Current Ratio 2.) Quick Ratio 3.)

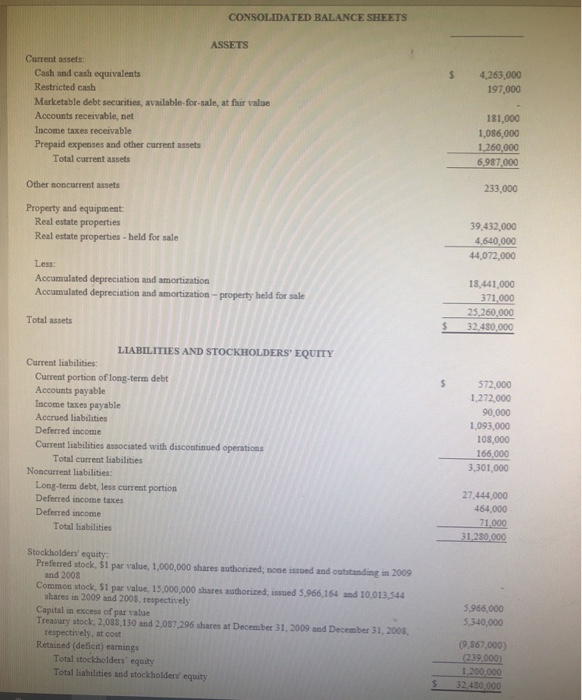

Problem 1 (10 Points): Compute the following Ratios based upon the financial statements provided below (1 Point Each): 1.) Current Ratio 2.) Quick Ratio 3.) Accounts Receivable Turnover 4.) Days Sales Outstanding ("DSOM) 5.) Total Asset Turnover Ratio 6.) Debt Ratio 7.) Operating Margin 8.) Profit Margin 9.) Return on Assets 10.) Return on Equity CONSOLIDATED BALANCE SHEETS 4,263,000 197,000 ASSETS Current assets: Cash and cash equivalents Restricted cash Marketable debt securities, available-for-sale, at fair value Accounts receivable, net Income taxes receivable Prepaid expenses and other current assets Total current assets 181,000 1,086,000 1,260,000 6,987,000 Other noncurrent assets 233,000 Property and equipment Real estate properties Real estate properties - held for sale 39,432,000 4,640,000 44,072,000 Accumulated depreciation and amortization Accumulated depreciation and amortization property held for sale 18,441,000 371.000 25.260.000 32.480,000 Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Current portion of long-term debt Accounts payable Income taxes payable Accrued liabilities Deferred income Current liabilities associated with discontinued operations Total current liabilities Noncurrent liabilities: Long-term debt, less current portion Deferred income taxes Deferred income Total liabilities 572,000 1,272,000 90.000 1.093,000 108,000 166,000 3,301.000 27,444,000 464,000 71.000 31,280,000 Stockholders' equity Preferred stock, 51 par value, 1,000,000 shares authorized: none issued and outstanding in 2009 and 2008 Common stock, $1 par value, 15,000,000 shares authorized issued 5.966.154 and 10.013.544 shares in 2009 and 2008, respectively Capital in excess of par value Treasury stock, 2,085,130 and 2,087,296 shares at December 31, 2009 and December 31, 2005, respectively, at cost Retained (deficit) earnings Total stockholders' equity Total liabilities and stockholders' equity 5,966,000 5,340,000 (9.867,000) 239.000 1.200.000 32.450,000 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts