Question: Problem 1 (10 pts) Suppose there are only 3 risky assets (stocks A, B and C) existing in the market, with the variance-covariance matrix of

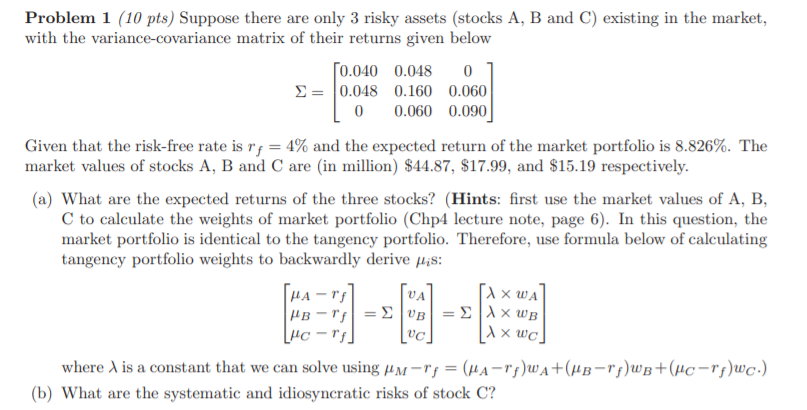

Problem 1 (10 pts) Suppose there are only 3 risky assets (stocks A, B and C) existing in the market, with the variance-covariance matrix of their returns given below [0.040 0.048 0 = 0.048 0.160 0.060 0 0.060 0.090 Given that the risk-free rate is r; = 4% and the expected return of the market portfolio is 8.826%. The market values of stocks A, B and C are (in million) $44.87, $17.99, and $15.19 respectively. (a) What are the expected returns of the three stocks? (Hints: first use the market values of A, B, C to calculate the weights of market portfolio (Chp4 lecture note, page 6). In this question, the market portfolio is identical to the tangency portfolio. Therefore, use formula below of calculating tangency portfolio weights to backwardly derive Mis: [HA-ri A) - r = = x wB Luc-" UC 1 x wc where is a constant that we can solve using um ry=(HA-rywa+(ub-rp)wB+(uc-rpwc.) (b) What are the systematic and idiosyncratic risks of stock C? VA 18 Problem 1 (10 pts) Suppose there are only 3 risky assets (stocks A, B and C) existing in the market, with the variance-covariance matrix of their returns given below [0.040 0.048 0 = 0.048 0.160 0.060 0 0.060 0.090 Given that the risk-free rate is r; = 4% and the expected return of the market portfolio is 8.826%. The market values of stocks A, B and C are (in million) $44.87, $17.99, and $15.19 respectively. (a) What are the expected returns of the three stocks? (Hints: first use the market values of A, B, C to calculate the weights of market portfolio (Chp4 lecture note, page 6). In this question, the market portfolio is identical to the tangency portfolio. Therefore, use formula below of calculating tangency portfolio weights to backwardly derive Mis: [HA-ri A) - r = = x wB Luc-" UC 1 x wc where is a constant that we can solve using um ry=(HA-rywa+(ub-rp)wB+(uc-rpwc.) (b) What are the systematic and idiosyncratic risks of stock C? VA 18

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts