Question: Bonus Problem 1 (Harder, 25 marks) (a) There are two risky assets in the market. You are given that the variances of assets' returns are

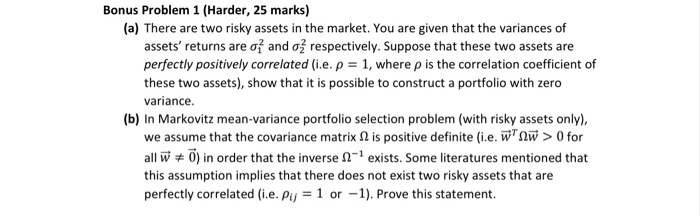

Bonus Problem 1 (Harder, 25 marks) (a) There are two risky assets in the market. You are given that the variances of assets' returns are o and o respectively. Suppose that these two assets are perfectly positively correlated i.e. p = 1, where p is the correlation coefficient of these two assets), show that it is possible to construct a portfolio with zero variance. (b) In Markovitz mean-variance portfolio selection problem (with risky assets only), we assume that the covariance matrix is positive definite (.e. w' nw > O for all w 0) in order that the inverse - exists. Some literatures mentioned that this assumption implies that there does not exist two risky assets that are perfectly correlated (i.e. Puj = 1 or -1). Prove this statement. Bonus Problem 1 (Harder, 25 marks) (a) There are two risky assets in the market. You are given that the variances of assets' returns are o and o respectively. Suppose that these two assets are perfectly positively correlated i.e. p = 1, where p is the correlation coefficient of these two assets), show that it is possible to construct a portfolio with zero variance. (b) In Markovitz mean-variance portfolio selection problem (with risky assets only), we assume that the covariance matrix is positive definite (.e. w' nw > O for all w 0) in order that the inverse - exists. Some literatures mentioned that this assumption implies that there does not exist two risky assets that are perfectly correlated (i.e. Puj = 1 or -1). Prove this statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts