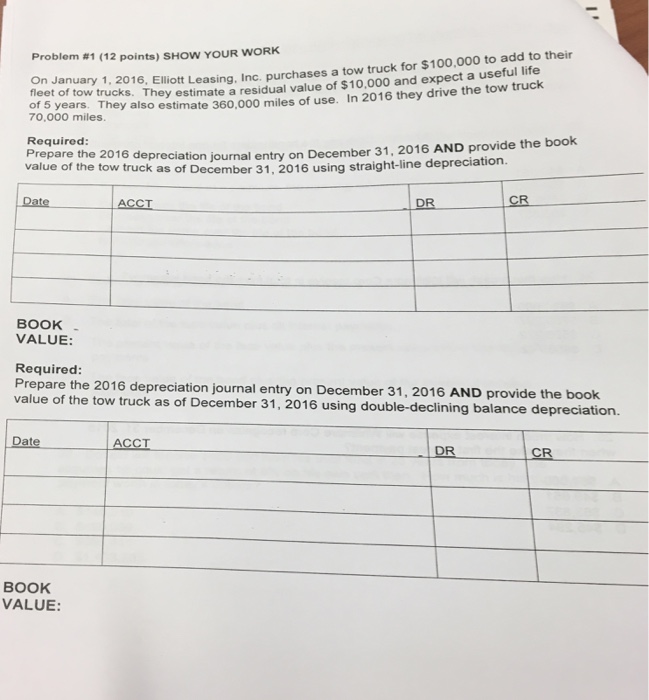

Question: Problem #1 (12 points) sHow YoUR wORK s10o.ooo to add to their January Elliott Leasing, Inc. purchases a tow truck for life fleet of trucks.

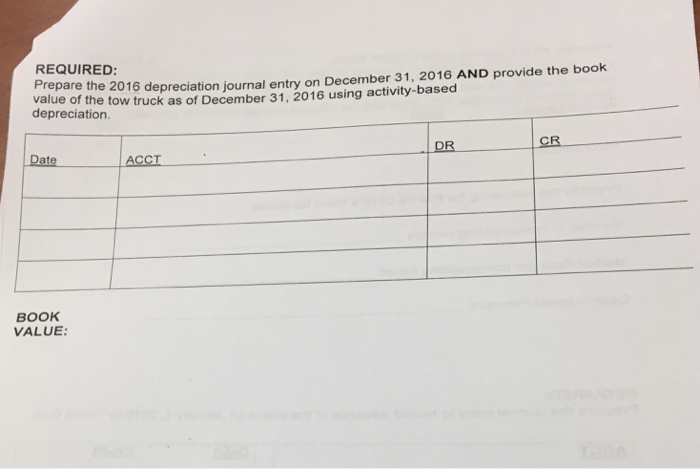

Problem #1 (12 points) sHow YoUR wORK s10o.ooo to add to their January Elliott Leasing, Inc. purchases a tow truck for life fleet of trucks. They estimate a residual value of $10,000 and expect a useful years. They also miles of use. In 2016 the tow truck 70.000 miles. estimate Required: 2016 AND provide the book value of the tow depreciation journal entry on December 31, depreciation. using straight-line Prepare December 31, 2016 BOOK VALUE: Required: Prepare the 2016 depreciation on December 31, 2016 AND provide the book value of the tow truck December 31, 2016 using double-declining balance depreciation. Da ACCT DR CR BOOK VALUE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts