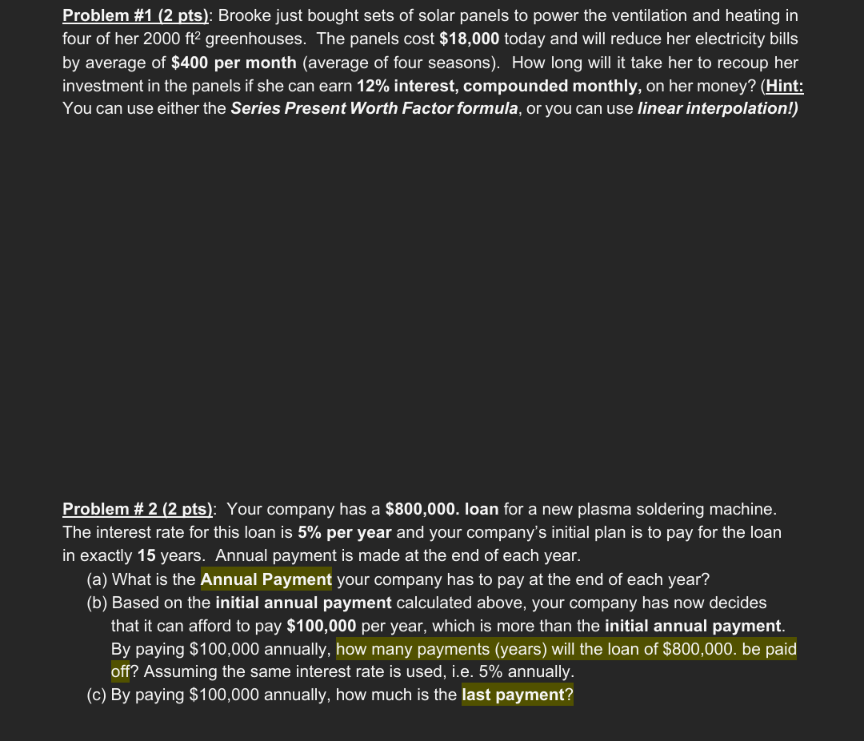

Question: Problem # 1 ( 2 pts ) : Brooke just bought sets of solar panels to power the ventilation and heating in four of her

Problem # pts: Brooke just bought sets of solar panels to power the ventilation and heating in

four of her greenhouses. The panels cost $ today and will reduce her electricity bills

by average of $ per month average of four seasons How long will it take her to recoup her

investment in the panels if she can earn interest, compounded monthly, on her money? Hint:

You can use either the Series Present Worth Factor formula, or you can use linear interpolation!

Problem # pts: Your company has a $ loan for a new plasma soldering machine.

The interest rate for this loan is per year and your company's initial plan is to pay for the loan

in exactly years. Annual payment is made at the end of each year.

a What is the Annual Payment your company has to pay at the end of each year?

b Based on the initial annual payment calculated above, your company has now decides

that it can afford to pay $ per year, which is more than the initial annual payment.

By paying $ annually, how many payments years will the loan of $ be paid

off? Assuming the same interest rate is used, ie annually.

c By paying $ annually, how much is the last payment?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock