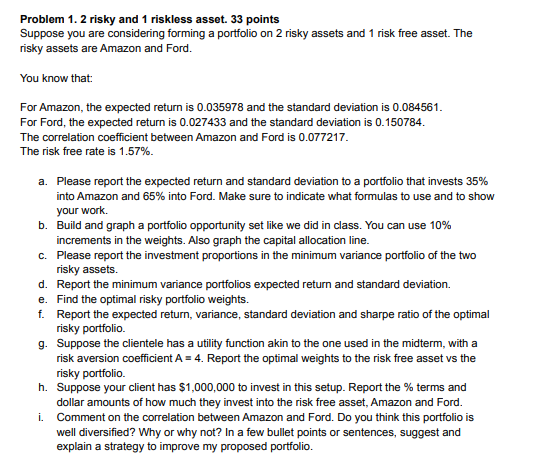

Question: Problem 1. 2 risky and 1 riskless asset. 33 points Suppose you are considering forming a portfolio on 2 risky assets and 1 risk free

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts