Question: Problem 1 [28 points) If the CAPM is valid (all securities and portfolios are priced as in CAPM), which of the following situations is possible

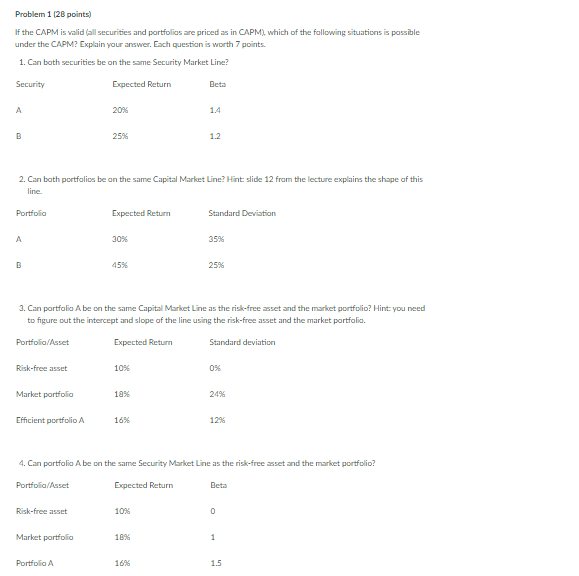

Problem 1 [28 points) If the CAPM is valid (all securities and portfolios are priced as in CAPM), which of the following situations is possible under the CAPM? Explain your answer. Each question is worth 7 points. 1. Can both securities be on the same Security Market Line? Security Expected Return Beta A 20% 1.4 B 25% 12 2. Can both portfolios be on the same Capital Market Line? Hint slide 12 from the lecture explains the shape of this line. Portfolio Expected Return Standard Deviation 30% 35% B 45% 25% 3. Can portfolio Abe on the same Capital Market Line as the risk-free asset and the market portfolio? Hints you need to figure out the intercept and slope of the line using the risk-free asset and the market portfolio. Portfolio/Asset Expected Return Standard deviation Risk-free asset 10% 0% Market portfolio 12% 24% Efficient portfolio A 16% 12% 4. Can portfolio Abe on the same Security Market Line as the risk-free asset and the market portfolio? Portfolio/Asset Expected Return Beta Risk-free asset 10% 0 Market portfolio 18% 1 Portfolio 16% 1.5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts