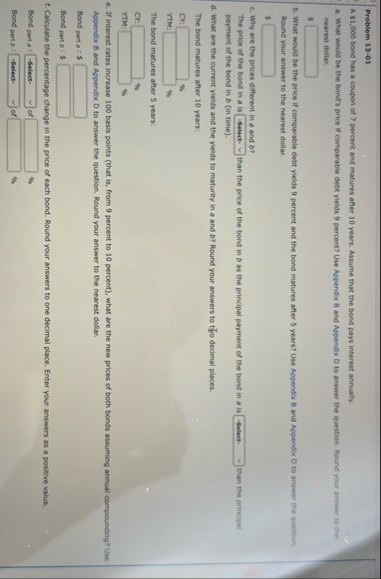

Question: Problem 1 3 - 0 1 A $ 1 , 0 0 0 bond has a coupon of 7 percent and matures after 1 0

Problem

A $ bond has a coupon of percent and matures after years. Assume that the bond pays interest annually.

a What would be the bond's price if comparable debt yields percent? Use Appendix B and Appendix D to answer the question. Round your answer to the nearest dollar.

$

b What would be the price if comparable debt yields percent and the bond matures after years? Use Appendx B and Appendix D to arswer the questich

Round your answer to the nearest dollar:

e why are the prices dfferent in a and b

The price of the bond in a is than the price of the bond in as the principal payment of the bond in a is than the principal payment of the bond in b in time

d What are the current yields and the yeids to maturity in a and b Round your answers to tho decimal places.

The bond matures after years:

Cr

YTM:

The bond matures after years:

CV:

YTM:

e If interest rates increase basis points that is from percent to percent what are the new prices of both bonds assuming annual compounding? Use Appendix. B and Appendix. D to answer the question. Round your answer to the nearest dollar.

Bond parta:

Bond part b : $

f Celoulate the perbentage change in the price of each bond. Round your answers to one decimal place. Enter your answers as a positive value.

Bond pert of of

Bond part it of

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock