Question: Problem 1 3 - 1 ( LO 4 ) Profit allocation based on various factors. Rockford, Skecba, and Tapinski are partners in a business which

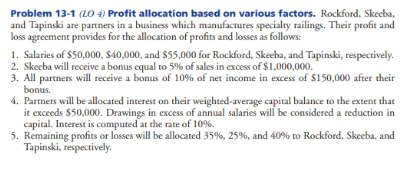

Problem LO Profit allocation based on various factors. Rockford, Skecba,

and Tapinski are partners in a business which manufactures specialty railings. Their profit and

loss agreement provides for the allocation of profits and losses as follows:

Salaries of $$ and $ for Rockford, Skeeba, and Tapinski, respectively.

Skeeba will receive a bonus equal to of sales in excess of $

All partners will receive a bonus of of net income in excess of $ after their

bonus.

Partners will be allocated interest on their weightedaverage capital balance to the extent that

it exceeds $ Drawings in excess of annual salaries will be considered a reduction in

capital. Interest is computed at the rate of

Remaining profirs or losses will be allocared and to Rockford, Skeeba, and

Tapinski, respectively.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock