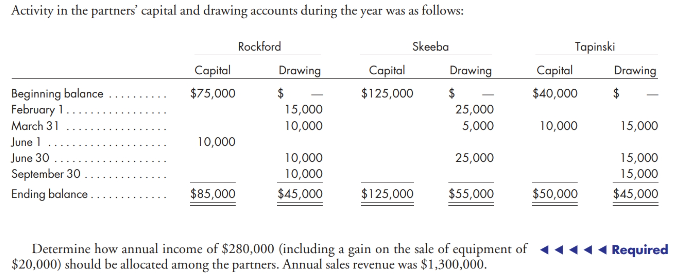

Question: Problem 1 3 - 1 ( LO 4 ) Profit allocation based on various factors. Rockford, Skeeba, and Tapinski are partners in a business which

Problem LO Profit allocation based on various factors. Rockford, Skeeba, and Tapinski are partners in a business which manufactures specialty railings. Their profit and loss agreement provides for the allocation of profits and losses as follows:

Salaries of $$and$for Rockford, Skeeba, and Tapinski, respectively.

Skeeba will receive a bonus equal to of sales in excess of $

All partners will receive a bonus of of net income in excess of $ after their

bonus.

Partners will be allocated interest on their weightedaverage capital balance to the extent that

it exceeds $ Drawings in excess of annual salaries will be considered a reduction in

capital. Interest is computed at the rate of

Remaining profits or losses will be allocated and to Rockford, Skeeba, and

Tapinski, respectively.

Gains or losses from the sale of depreciable assets will be excluded from the above provisions and will be equally allocated between Rockford and Tapinski.

Determine how annual income of $including a gain on the sale of equipment of

$ should be allocated among the partners. Annual sales revenue was $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock