Question: Problem 1 4 - 2 3 ( Alqo ) [ LO 1 4 - 3 , 1 4 - 5 ] Assessment Tool iFrame Dakota

Problem AlqoLO

Assessment Tool iFrame

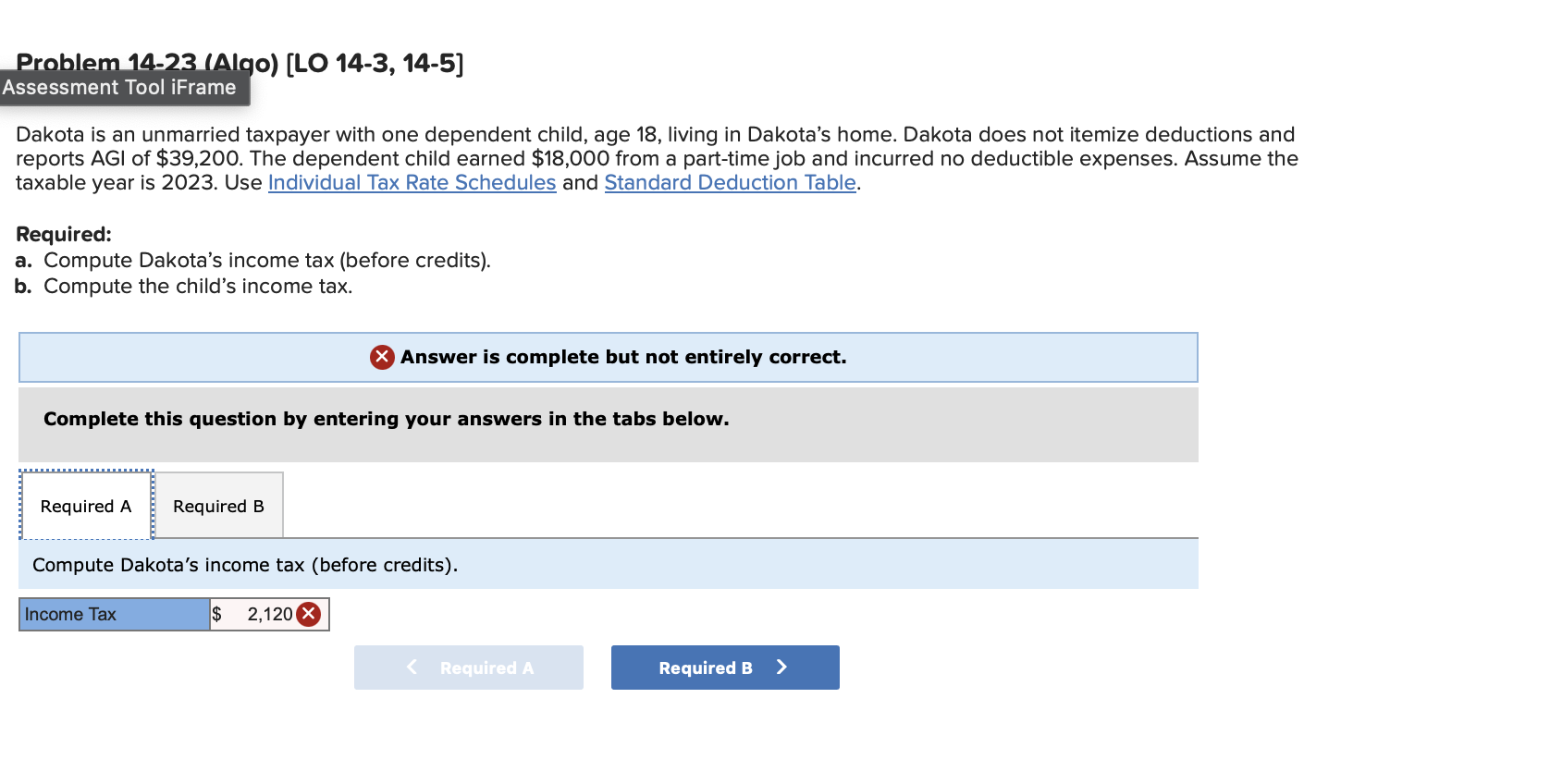

Dakota is an unmarried taxpayer with one dependent child, age living in Dakota's home. Dakota does not itemize deductions and reports AGI of $ The dependent child earned $ from a parttime job and incurred no deductible expenses. Assume the taxable year is Use Individual Tax Rate Schedules and Standard Deduction Table.

Required:

a Compute Dakota's income tax before credits

b Compute the child's income tax.

Answer is complete but not entirely correct.

Complete this question by entering your answers in the tabs below.

Compute Dakota's income tax before credits

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock