Question: Problem 1 5 - 4 0 ( LO . 6 , 9 ) True Corporation, a wholly owned subsidiary of Trumaine Corporation, generated a

Problem LO

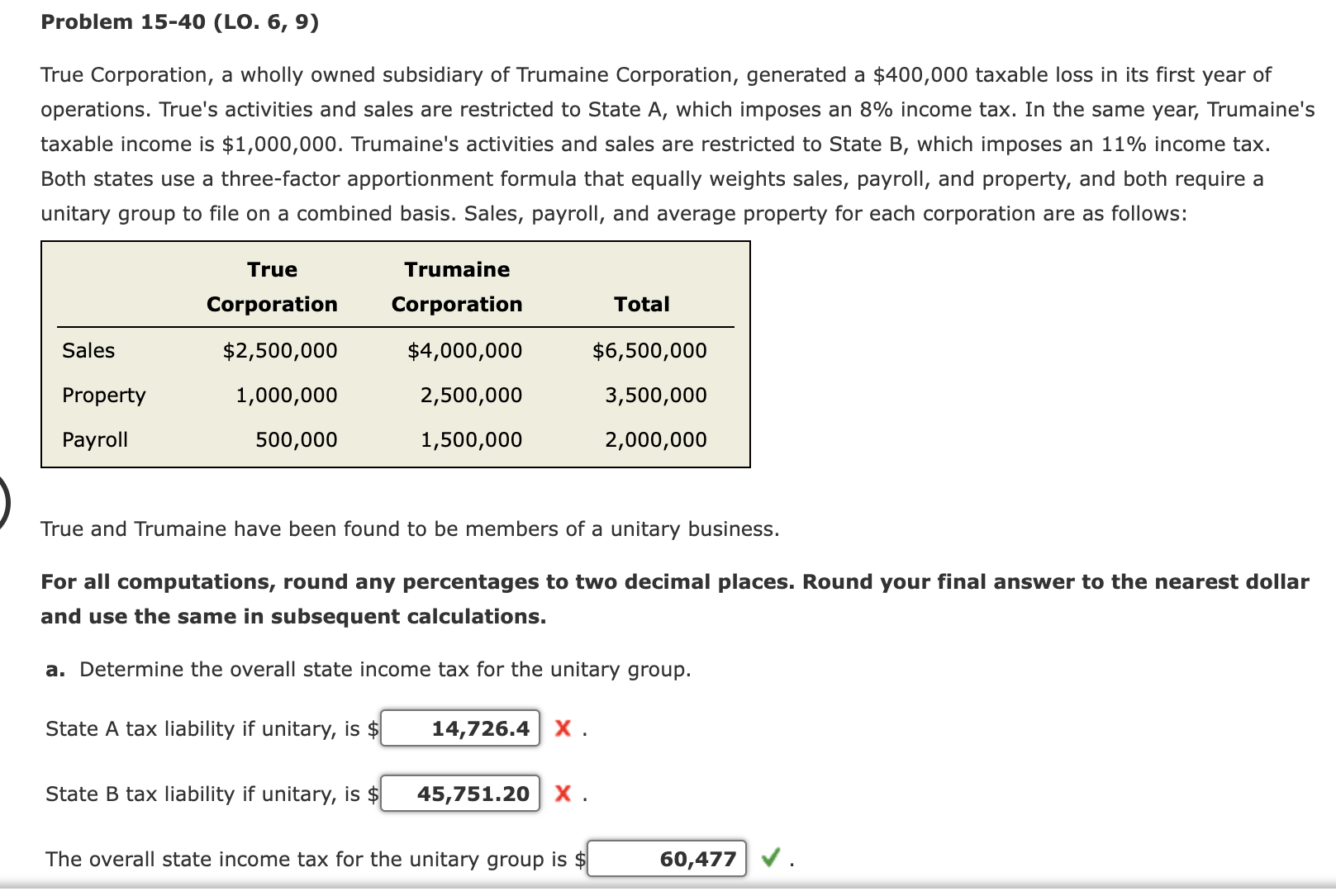

True Corporation, a wholly owned subsidiary of Trumaine Corporation, generated a $ taxable loss in its first year of operations. True's activities and sales are restricted to State A which imposes an income tax. In the same year, Trumaine's taxable income is $ Trumaine's activities and sales are restricted to State B which imposes an income tax. Both states use a threefactor apportionment formula that equally weights sales, payroll, and property, and both require a unitary group to file on a combined basis. Sales, payroll, and average property for each corporation are as follows:True CorporationTrumaine Corporation

True and Trumaine have been found to be members of a unitary business.

For all computations, round any percentages to two decimal places. Round your final answer to the nearest dollar and use the same in subsequent calculations.

a Determine the overall state income tax for the unitary group.

State A tax liability if unitary, is $

State B tax liability if unitary, is ddagger

The overall state income tax for the unitary group is ddagger

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock