Question: Problem #1 (6 points) I am considering two mutually exclusive investments. I want to use a risk adjusted discount rate on order to assess my

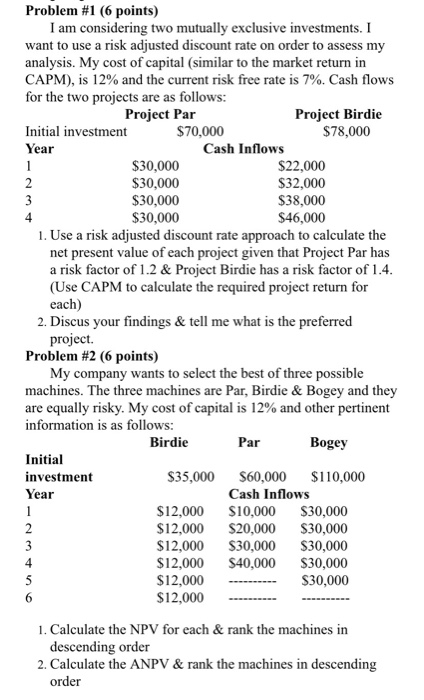

Problem #1 (6 points) I am considering two mutually exclusive investments. I want to use a risk adjusted discount rate on order to assess my analysis. My cost of capital (similar to the market return in CAPM), is 12% and the current risk free rate is 7%. Cash flows for the two projects are as follows: Project Par Project Birdie Initial investment $70,000 $78,000 Year Cash Inflows $30,000 $22,000 $30,000 $32,000 $30,000 $38,000 $30,000 $46,000 1. Use a risk adjusted discount rate approach to calculate the net present value of each project given that Project Par has a risk factor of 1.2 & Project Birdie has a risk factor of 1.4. (Use CAPM to calculate the required project return for each) 2. Discus your findings & tell me what is the preferred project. Problem #2 (6 points) My company wants to select the best of three possible machines. The three machines are Par, Birdie & Bogey and they are equally risky. My cost of capital is 12% and other pertinent information is as follows: Birdie Par Bogey Initial investment $35,000 $60,000 $110,000 Year Cash Inflows $12,000 $10,000 $30,000 $12,000 $20,000 $30,000 $12,000 $30,000 $30,000 $12,000 $40,000 $30,000 $12,000 $30,000 $12,000 1. Calculate the NPV for each & rank the machines in descending order 2. Calculate the ANPV & rank the machines in descending order

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts