Question: Problem #5 (8 points) You are considering two mutually exclusive projects & you want to use a risk adjusted rate (RADR) to help make your

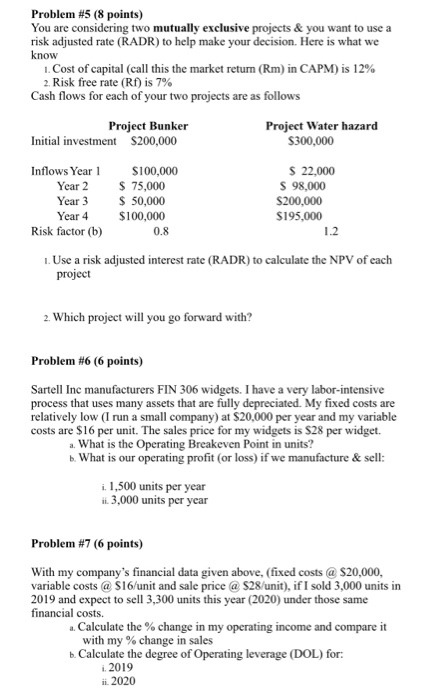

Problem #5 (8 points) You are considering two mutually exclusive projects & you want to use a risk adjusted rate (RADR) to help make your decision. Here is what we know 1. Cost of capital (call this the market return (Rm) in CAPM) is 12% 2. Risk free rate (Rf) is 7% Cash flows for each of your two projects are as follows Project Bunker Initial investment S200,000 Project Water hazard $300,000 Inflows Year Year 2 Year 3 Year 4 Risk factor (b) $100,000 $ 75,000 $ 50,000 $100,000 0.8 $ 22,000 $ 98,000 $200,000 $195,000 1.2 1. Use a risk adjusted interest rate (RADR) to calculate the NPV of each project 2. Which project will you go forward with? Problem #6 (6 points) Sartell Inc manufacturers FIN 306 widgets. I have a very labor-intensive process that uses many assets that are fully depreciated. My fixed costs are relatively low (I run a small company) at $20,000 per year and my variable costs are $16 per unit. The sales price for my widgets is $28 per widget. a. What is the Operating Breakeven Point in units? b. What is our operating profit (or loss) if we manufacture & sell: i. 1.500 units per year 11.3,000 units per year Problem #7 (6 points) With my company's financial data given above, (fixed costs @ $20,000, variable costs @ $16/unit and sale price @ S28/unit), if I sold 3,000 units in 2019 and expect to sell 3,300 units this year (2020) under those same financial costs. Calculate the % change in my operating income and compare it with my % change in sales b. Calculate the degree of Operating leverage (DOL) for: i. 2019 ii. 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts