Question: Problem 1 . ( 6 points ) The process for the prices of a 5 - year maturity zero - coupon bond and of a

Problem points

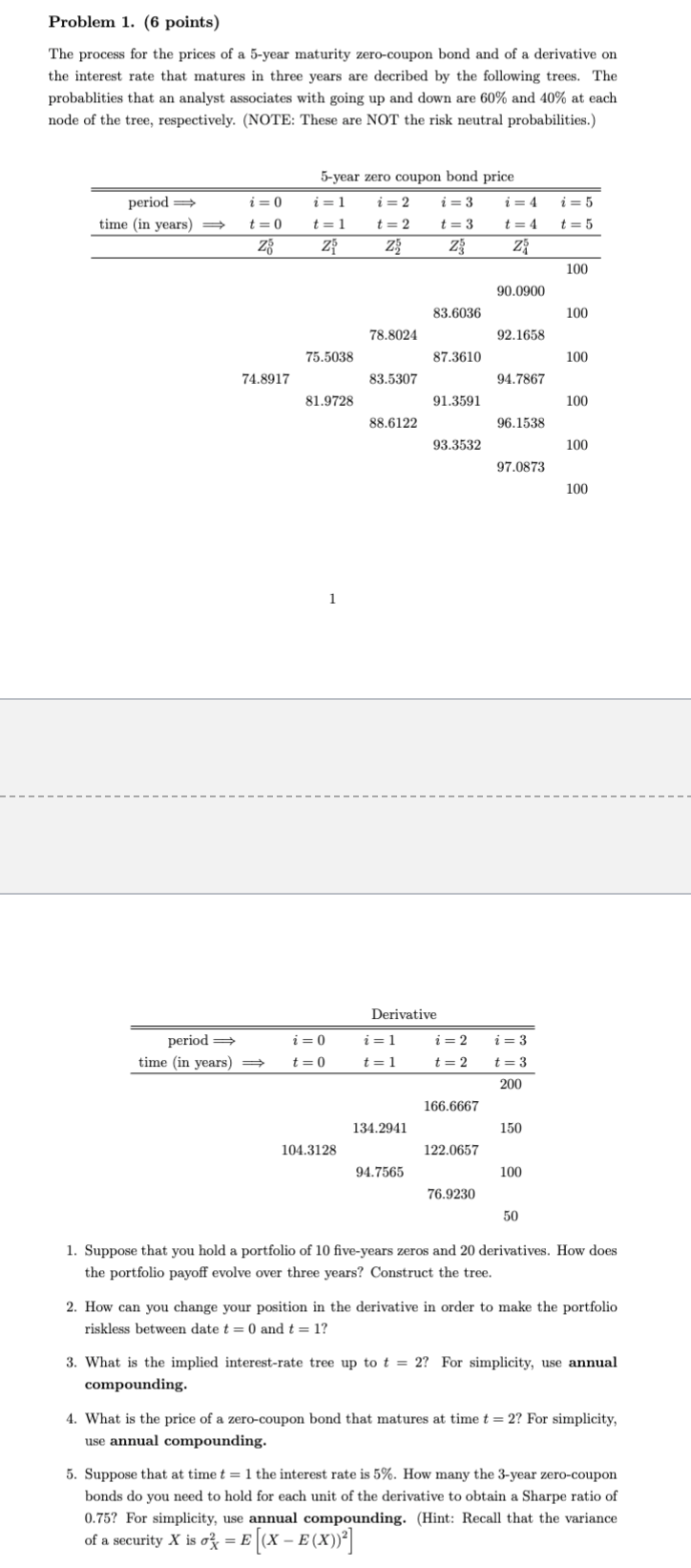

The process for the prices of a year maturity zerocoupon bond and of a derivative on

the interest rate that matures in three years are decribed by the following trees. The

probablities that an analyst associates with going up and down are and at each

node of the tree, respectively. NOTE: These are NOT the risk neutral probabilities.

year zero coupon bond price

Suppose that you hold a portfolio of fiveyears zeros and derivatives. How does

the portfolio payoff evolve over three years? Construct the tree.

How can you change your position in the derivative in order to make the portfolio

riskless between date and

What is the implied interestrate tree up to For simplicity, use annual

compounding.

What is the price of a zerocoupon bond that matures at time For simplicity,

use annual compounding.

Suppose that at time the interest rate is How many the year zerocoupon

bonds do you need to hold for each unit of the derivative to obtain a Sharpe ratio of

For simplicity, use annual compounding. Hint: Recall that the variance

of a security is

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock