Question: Problem 1 8 - 1 5 Capacity Use and External Financing ( LO 2 ) Sales and costs are projected to grow at 3 0

Problem Capacity Use and External Financing LO Sales and costs are projected to grow at a year for at least the next years. Both current assets and accounts payable are

projected to rise in proportion to sales. The firm is currently operating at full capacity, so it plans to increase fixed assets in proportion

to sales. Interest expense will equal of longterm debt outstanding at the start of the year. The firm will maintain a dividend payout

ratio of

If Growth Industries is operating at only of capacity, how much can sales grow before the firm will need to raise any external

funds? Assume that once fixed assets are operating at capacity, they will need to grow thereafter in direct proportion to sales.

Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.

Final sales

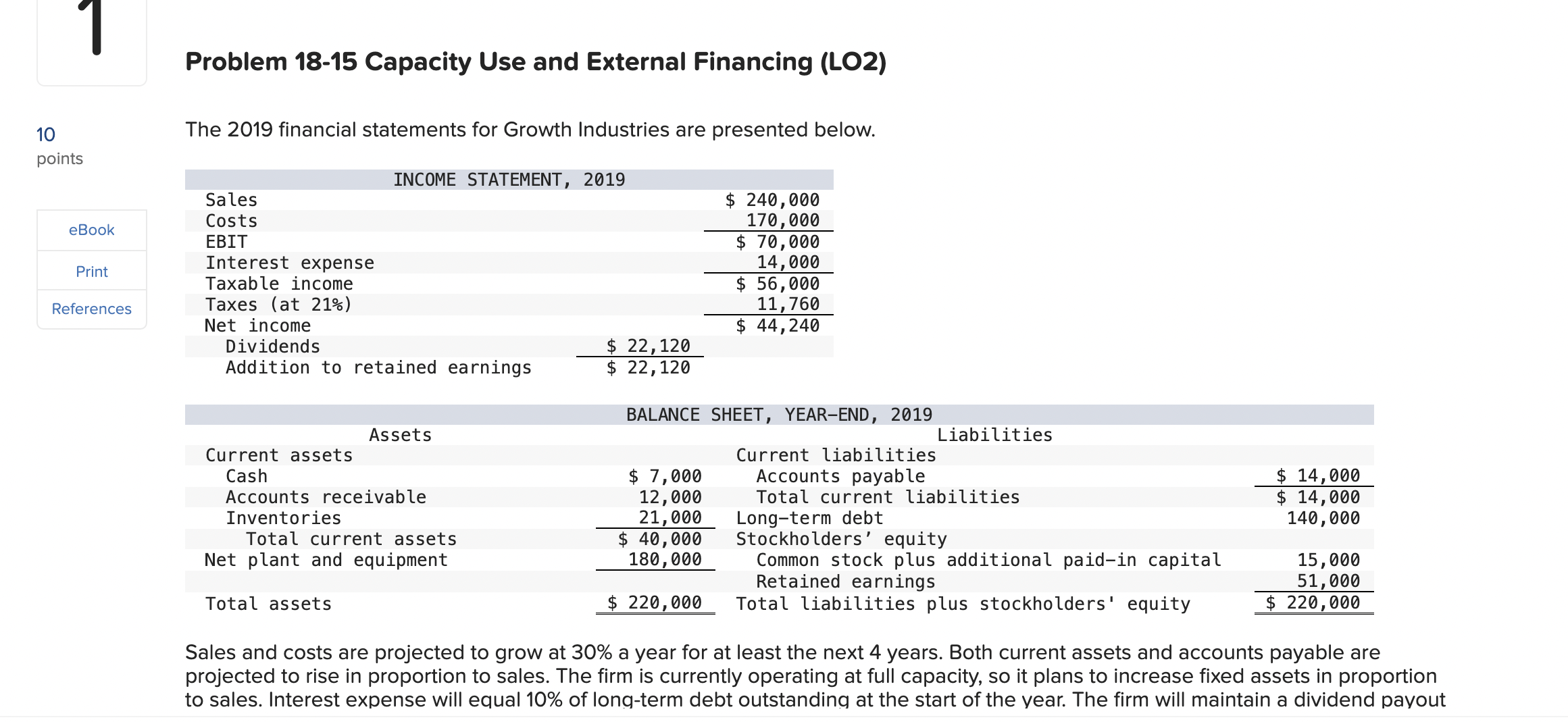

The financial statements for Growth Industries are presented below.

Sales and costs are projected to grow at a year for at least the next years. Both current assets and accounts payable are

projected to rise in proportion to sales. The firm is currently operating at full capacity, so it plans to increase fixed assets in proportion

to sales. Interest expense will equal of longterm debt outstanding at the start of the vear. The firm will maintain a dividend payout

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock