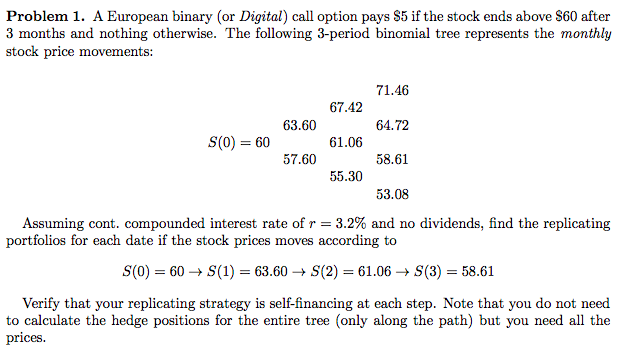

Question: Problem 1. A European binary (or Digital) call option pays s5 if the stock ends above S60 after 3 months and nothing otherwise. The following

Problem 1. A European binary (or Digital) call option pays s5 if the stock ends above S60 after 3 months and nothing otherwise. The following 3-period binomial tree represents the monthly stock price movements: 67.42 61.06 55.30 71.46 64.72 58.61 53.08 63.60 S(0-60 57.60 Assuming cont. compounded interest rate of r 32% and no dividends, find the replicating portfolios for each date if the stock prices moves according to S(0) 60S(1) 63.60S(2) 61.06 S(3) 58.61 Verify that your replicating strategy is self-financing at each step. Note that you do not need to calculate the hedge positions for the entire tree (only along the path) but you need all the prices

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts