Question: PROBLEM 1 Alpha Inc. and Beta Co. are competitors in the technology sector. They both released their financial statements for the fiscal year ending on

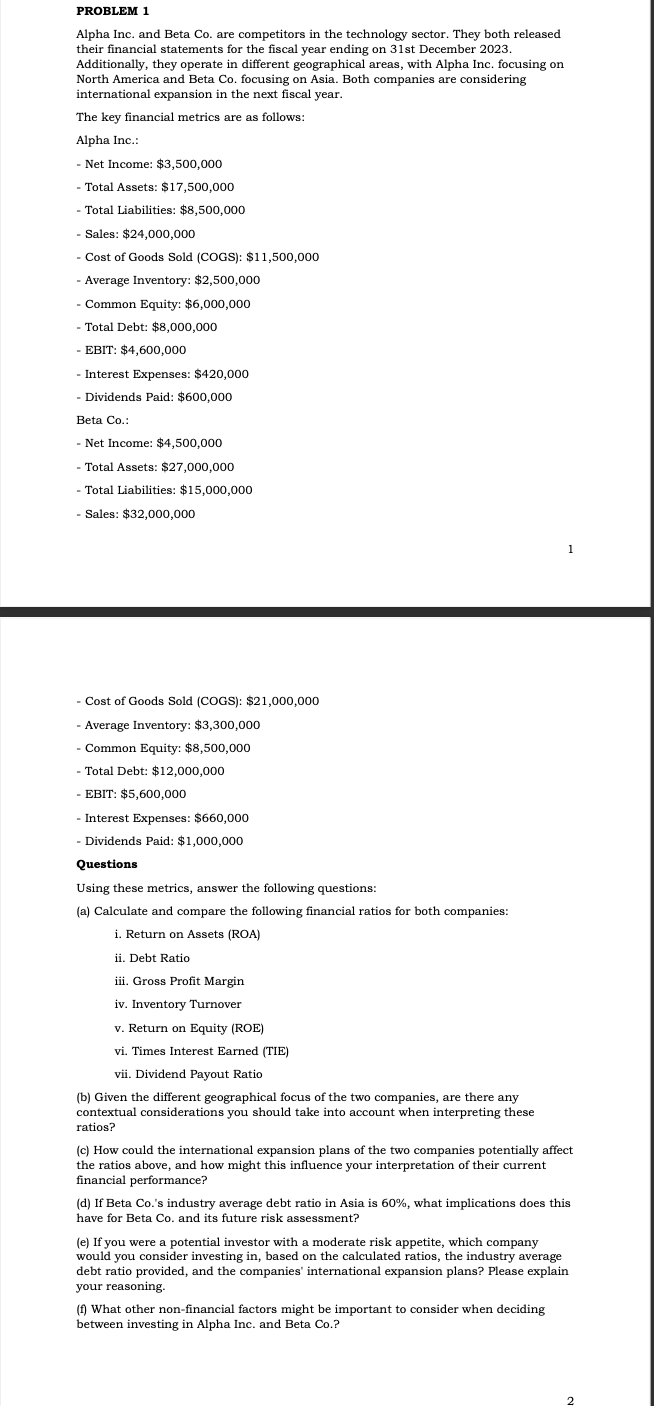

PROBLEM 1 Alpha Inc. and Beta Co. are competitors in the technology sector. They both released their financial statements for the fiscal year ending on 31st December 2023. Additionally, they operate in different geographical areas, with Alpha Inc. focusing on North America and Beta Co. focusing on Asia. Both companies are considering international expansion in the next fiscal year. The key financial metrics are as follows: Alpha Inc.: - Net Income: $3,500,000 - Total Assets: \$17,500,000 - Total Liabilities: $8,500,000 - Sales: \$24,000,000 - Cost of Goods Sold (COGS): \$11,500,000 - Average Inventory: \$2,500,000 - Common Equity: $6,000,000 - Total Debt: $8,000,000 - EBIT: $4,600,000 - Interest Expenses: \$420,000 - Dividends Paid: $600,000 Beta Co.: - Net Income: \$4,500,000 - Total Assets: \$27,000,000 - Total Liabilities: $15,000,000 - Sales: $32,000,000 1 - Cost of Goods Sold (COGS): \$21,000,000 - Average Inventory: \$3,300,000 - Common Equity: $8,500,000 - Total Debt: \$12,000,000 - EBIT: $5,600,000 - Interest Expenses: \$660,000 - Dividends Paid: \$1,000,000 Questions Using these metrics, answer the following questions: (a) Calculate and compare the following financial ratios for both companies: i. Return on Assets (ROA) ii. Debt Ratio iii. Gross Profit Margin iv. Inventory Turnover v. Return on Equity (ROE) vi. Times Interest Earned (TIE) vii. Dividend Payout Ratio (b) Given the different geographical focus of the two companies, are there any contextual considerations you should take into account when interpreting these ratios? (c) How could the international expansion plans of the two companies potentially affect the ratios above, and how might this influence your interpretation of their current financial performance? (d) If Beta Co.'s industry average debt ratio in Asia is 60%, what implications does this have for Beta Co. and its future risk assessment? (e) If you were a potential investor with a moderate risk appetite, which company would you consider investing in, based on the calculated ratios, the industry average debt ratio provided, and the companies' international expansion plans? Please explain your reasoning. (f) What other non-financial factors might be important to consider when deciding between investing in Alpha Inc. and Beta Co.? PROBLEM 1 Alpha Inc. and Beta Co. are competitors in the technology sector. They both released their financial statements for the fiscal year ending on 31st December 2023. Additionally, they operate in different geographical areas, with Alpha Inc. focusing on North America and Beta Co. focusing on Asia. Both companies are considering international expansion in the next fiscal year. The key financial metrics are as follows: Alpha Inc.: - Net Income: $3,500,000 - Total Assets: \$17,500,000 - Total Liabilities: $8,500,000 - Sales: \$24,000,000 - Cost of Goods Sold (COGS): \$11,500,000 - Average Inventory: \$2,500,000 - Common Equity: $6,000,000 - Total Debt: $8,000,000 - EBIT: $4,600,000 - Interest Expenses: \$420,000 - Dividends Paid: $600,000 Beta Co.: - Net Income: \$4,500,000 - Total Assets: \$27,000,000 - Total Liabilities: $15,000,000 - Sales: $32,000,000 1 - Cost of Goods Sold (COGS): \$21,000,000 - Average Inventory: \$3,300,000 - Common Equity: $8,500,000 - Total Debt: \$12,000,000 - EBIT: $5,600,000 - Interest Expenses: \$660,000 - Dividends Paid: \$1,000,000 Questions Using these metrics, answer the following questions: (a) Calculate and compare the following financial ratios for both companies: i. Return on Assets (ROA) ii. Debt Ratio iii. Gross Profit Margin iv. Inventory Turnover v. Return on Equity (ROE) vi. Times Interest Earned (TIE) vii. Dividend Payout Ratio (b) Given the different geographical focus of the two companies, are there any contextual considerations you should take into account when interpreting these ratios? (c) How could the international expansion plans of the two companies potentially affect the ratios above, and how might this influence your interpretation of their current financial performance? (d) If Beta Co.'s industry average debt ratio in Asia is 60%, what implications does this have for Beta Co. and its future risk assessment? (e) If you were a potential investor with a moderate risk appetite, which company would you consider investing in, based on the calculated ratios, the industry average debt ratio provided, and the companies' international expansion plans? Please explain your reasoning. (f) What other non-financial factors might be important to consider when deciding between investing in Alpha Inc. and Beta Co

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts