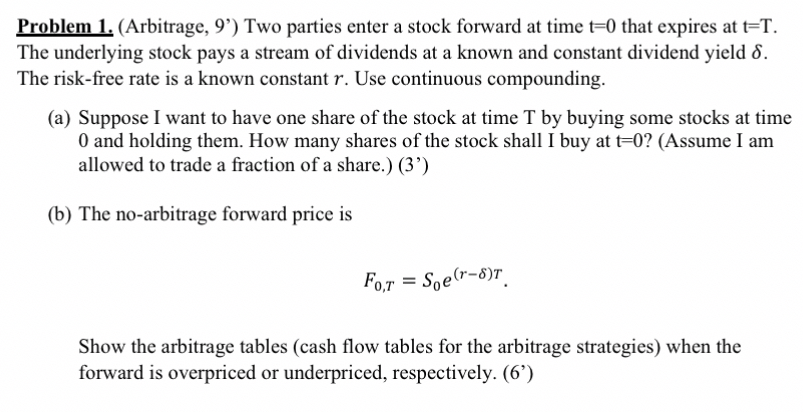

Question: Problem 1 . ( Arbitrage , 9 ' ) Two parties enter a stock forward at time t = 0 that expires at t =

Problem Arbitrage Two parties enter a stock forward at time that expires at

The underlying stock pays a stream of dividends at a known and constant dividend yield

The riskfree rate is a known constant Use continuous compounding.

a Suppose I want to have one share of the stock at time T by buying some stocks at time

and holding them. How many shares of the stock shall I buy at Assume I am

allowed to trade a fraction of a share.

b The noarbitrage forward price is

Show the arbitrage tables cash flow tables for the arbitrage strategies when the

forward is overpriced or underpriced, respectively.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock