Question

Mobile One Inc. CFO is interested in calculating the weighted average cost of capital and the company has collected the following information: 1 The

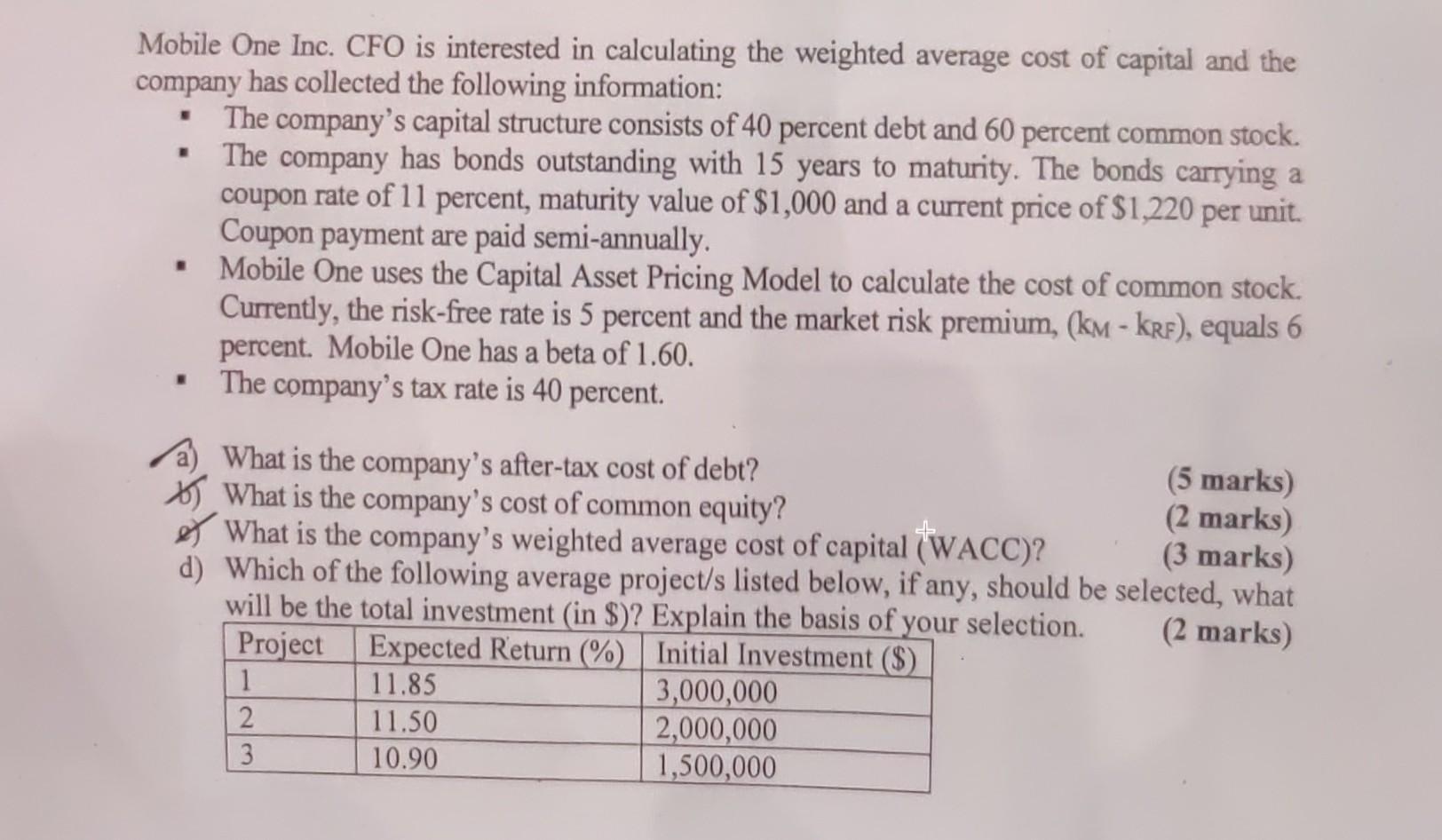

Mobile One Inc. CFO is interested in calculating the weighted average cost of capital and the company has collected the following information: 1 The company's capital structure consists of 40 percent debt and 60 percent common stock. The company has bonds outstanding with 15 years to maturity. The bonds carrying a coupon rate of 11 percent, maturity value of $1,000 and a current price of $1,220 per unit. Coupon payment are paid semi-annually. Mobile One uses the Capital Asset Pricing Model to calculate the cost of common stock. Currently, the risk-free rate is 5 percent and the market risk premium, (kM - KRF), equals 6 percent. Mobile One has a beta of 1.60. The company's tax rate is 40 percent. W What is the company's after-tax cost of debt? (5 marks) (2 marks) What is the company's cost of common equity? What is the company's weighted average cost of capital (WACC)? (3 marks) d) Which of the following average project/s listed below, if any, should be selected, what will be the total investment (in $)? Explain the basis of your selection. (2 marks) Project Expected Return (%) Initial Investment ($) 11.85 11.50 10.90 1 2 3 3,000,000 2,000,000 1,500,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The image depicts a text outlining some financial data related to a company Mobile One Inc and includes questions a through d about the companys after...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started