Question: Problem 1: Bond pricing (2 points) Are the following statements true or false? Please briefly explain your answer. In both parts assume that the default

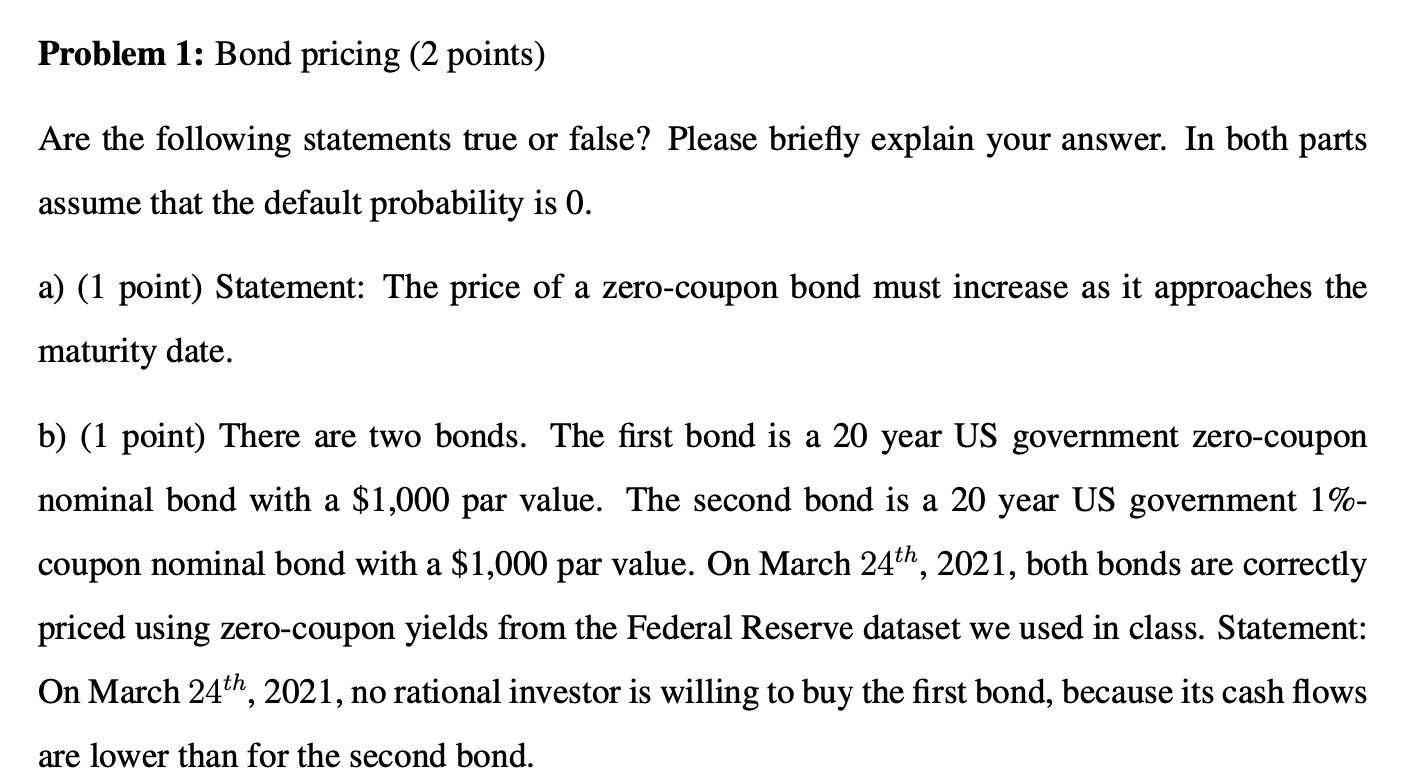

Problem 1: Bond pricing (2 points) Are the following statements true or false? Please briefly explain your answer. In both parts assume that the default probability is 0. a) (1 point) Statement: The price of a zero-coupon bond must increase as it approaches the maturity date. b) (1 point) There are two bonds. The first bond is a 20 year US government zero-coupon nominal bond with a $1,000 par value. The second bond is a 20 year US government 1%- coupon nominal bond with a $1,000 par value. On March 24th, 2021, both bonds are correctly priced using zero-coupon yields from the Federal Reserve dataset we used in class. Statement: On March 24th, 2021, no rational investor is willing to buy the first bond, because its cash flows are lower than for the second bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts