Question: Problem 1 Consider a three period model with two assets, a safe and an unsafe asset. The safe asset always has a price of pts=1

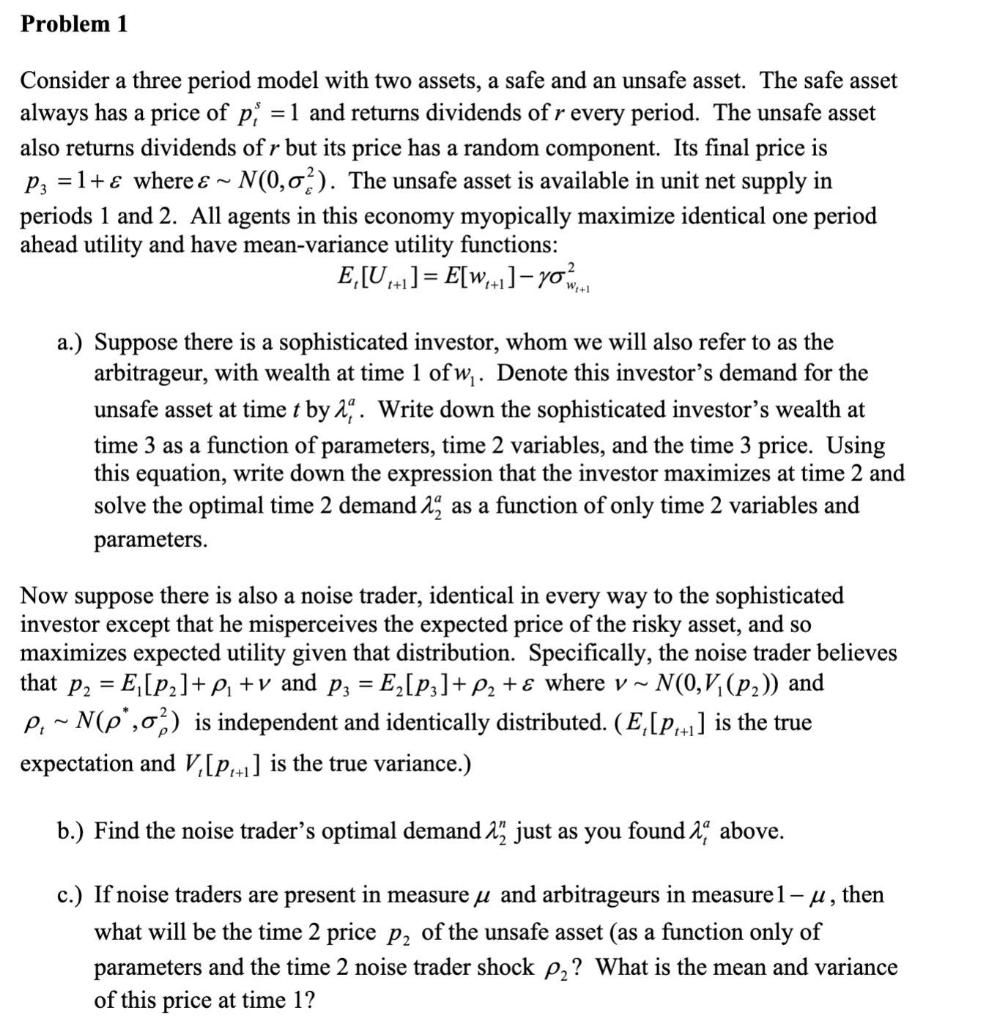

Problem 1 Consider a three period model with two assets, a safe and an unsafe asset. The safe asset always has a price of pts=1 and returns dividends of r every period. The unsafe asset also returns dividends of r but its price has a random component. Its final price is p3=1+ where N(0,2). The unsafe asset is available in unit net supply in periods 1 and 2. All agents in this economy myopically maximize identical one period ahead utility and have mean-variance utility functions: Et[Ut+1]=E[wt+1]wt+12 a.) Suppose there is a sophisticated investor, whom we will also refer to as the arbitrageur, with wealth at time 1 of w1. Denote this investor's demand for the unsafe asset at time t by ta. Write down the sophisticated investor's wealth at time 3 as a function of parameters, time 2 variables, and the time 3 price. Using this equation, write down the expression that the investor maximizes at time 2 and solve the optimal time 2 demand 2a as a function of only time 2 variables and parameters. Now suppose there is also a noise trader, identical in every way to the sophisticated investor except that he misperceives the expected price of the risky asset, and so maximizes expected utility given that distribution. Specifically, the noise trader believes that p2=E1[p2]+1+v and p3=E2[p3]+2+ where vN(0,V1(p2)) and tN(,2) is independent and identically distributed. (Et[pt+1] is the true expectation and Vt[pt+1] is the true variance.) b.) Find the noise trader's optimal demand 2n just as you found ta above. c.) If noise traders are present in measure and arbitrageurs in measure 1, then what will be the time 2 price p2 of the unsafe asset (as a function only of parameters and the time 2 noise trader shock 2 ? What is the mean and variance of this price at time 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts