Question: Problem 1. Consider a three-year swap contract between Apple and Microsoft where Apple agrees to pay a fixed rate of 2.6% per annum on a

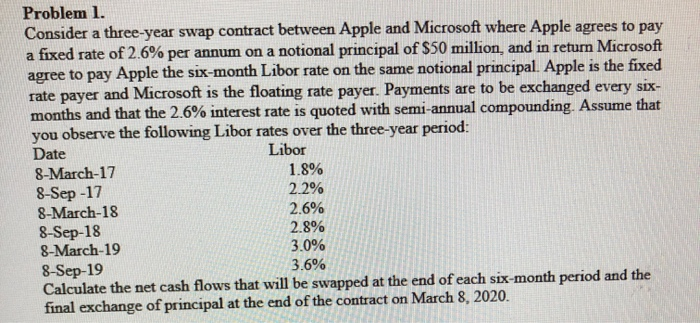

Problem 1. Consider a three-year swap contract between Apple and Microsoft where Apple agrees to pay a fixed rate of 2.6% per annum on a notional principal of $50 million, and in return Microsoft agree to pay Apple the six-month Libor rate on the same notional principal. Apple is the fixed rate payer and Microsoft is the floating rate payer. Payments are to be exchanged every six- months and that the 2.6% interest rate is quoted with semi-annual compounding. Assume that you observe the following Libor rates over the three-year period: Date Libor 8-March-17 1.8% 8-Sep-17 2.2% 8-March-18 2.6% 8-Sep-18 2.8% 8-March-19 8-Sep-19 3.6% Calculate the net cash flows that will be swapped at the end of each six-month period and the final exchange of principal at the end of the contract on March 8, 2020. 3.0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts