Question: Problem 1 Consider the following data: Free Cash Flow 1 = $27 million; Free Cash Flow 2 = $43 million; Free Cash Flow 3 =

Problem 1

Consider the following data:

Free Cash Flow 1 = $27 million;

Free Cash Flow 2 = $43 million;

Free Cash Flow 3 = $48 million.

Free Cash Flow 4= $62 million.

Assume that free cash flow grows at a rate of 6 percent for year 5 and beyond. If the weighted average cost of capital is 12 percent, calculate the value of the firm.

Problem 2

An Electronics shop provides specialty-manufacturing service. The initial outlay is $30 million and, management estimates that the firm might generate cash flows for years one through five equal to $5,000,000; $7,500,000; $10,500,000; $20,000,000; and $20,000,000.

The company uses a 20% discount rate for projects of this type.

Is this a good investment opportunity? Explain your answer

Problem 3

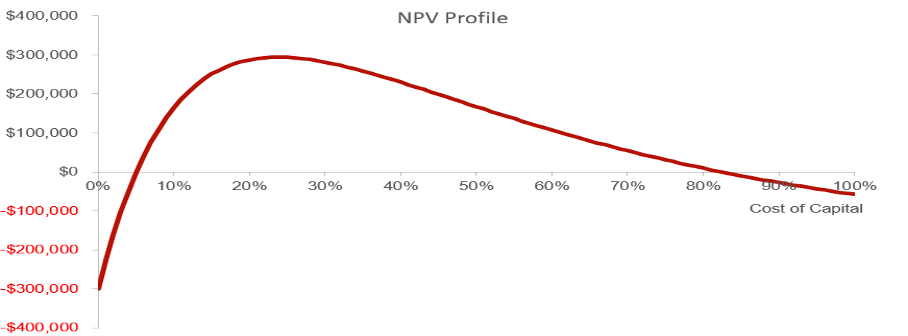

The graph below represents the IRR of one of the project your company is considering

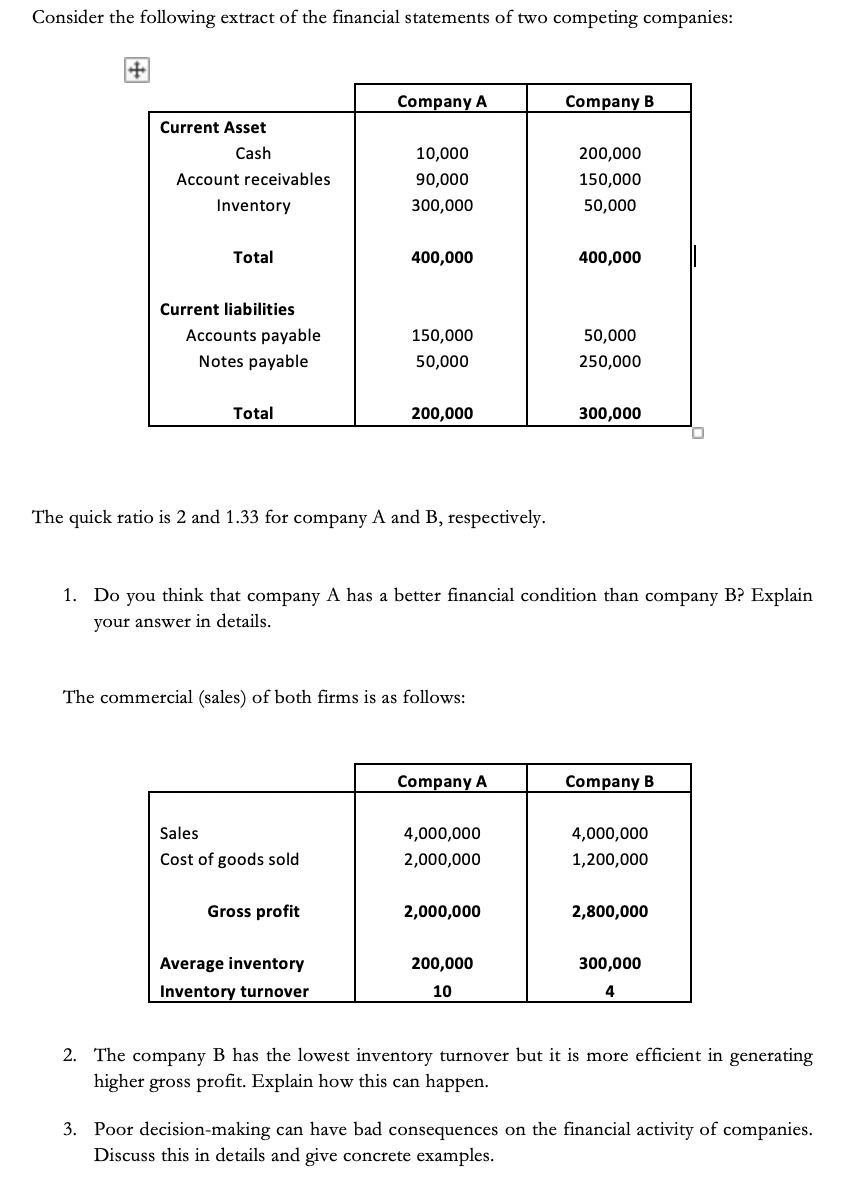

Consider the following extract of the financial statements of two competing companies: Company A Company B Current Asset Cash 10,000 200,000 Account receivables 90,000 150,000 Inventory 300,000 50,000 Total 400,000 400,000 Current liabilities Accounts payable 150,000 50,000 Notes payable 50,000 250,000 Total 200,000 300,000 The quick ratio is 2 and 1.33 for company A and B, respectively. 1. Do you think that company A has a better financial condition than company B? Explain your answer in details. The commercial (sales) of both firms is as follows: Company A Company B Sales 4,000,000 4,000,000 Cost of goods sold 2,000,000 1,200,000 Gross profit 2,000,000 2,800,000 Average inventory 200,000 300,000 Inventory turnover 10 2. The company B has the lowest inventory turnover but it is more efficient in generating higher gross profit. Explain how this can happen. 3. Poor decision-making can have bad consequences on the financial activity of companies. Discuss this in details and give concrete examples.\f

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts